# The tech industry and financial markets often dance a complex tango, leading us through a maze of highs and lows, breakthroughs, and setbacks. As a product manager leader in the tech industry and an enthusiast for making technical jargon a tad more digestible (and why not, more entertaining), let’s dive into the ocean of recent trends, outcomes, and futuristic talk dominating our digital realm. Buckle up – it’s quite the journey!

1. Indicators & Future Tenders: The 2024 Market Rally Riddle

The stock market began 2024 somewhat akin to a grizzled rocket, hurling through a field of financial asteroids—dodging, weaving, and occasionally taking a hit. The major stock indices have shown that even giants can snap, with a noticeable plunge breaking a nine-week soaring streak. The S&P 500, that broad canvas reflecting corporate America, along with a slew of leading stocks, teased traders by finding support late in the week – a glimmer of hope, perhaps? While some stocks showed bullish buy signals, one must ponder if these are but a mirage, contingent on the market’s rebound efforts. Take Nvidia (NVDA), for instance. The AI chip leviathan managed to sprinkle a bit of fairy dust on investors by rebounding, meandering close to a buy point. Keen onlookers across Wall Street and Silicon Valley alike wait with bated breath, eyeing Nvidia’s prediction of a $100 billion free cash flow booster shot coming over the next two orbit cycles around the sun (that’s two years for us earthlings). Yet, the bond market hangs above like the sword of Damocles, with Treasury yields lounging around the 4% mark, compelling equities to nod along to its seemingly soporific tune. In this financial concert, knowing the lyrics to the bond market’s leading melody can mean the difference between crescendo and diminuendo in your investment portfolio.

The stock market began 2024 somewhat akin to a grizzled rocket, hurling through a field of financial asteroids—dodging, weaving, and occasionally taking a hit. The major stock indices have shown that even giants can snap, with a noticeable plunge breaking a nine-week soaring streak. The S&P 500, that broad canvas reflecting corporate America, along with a slew of leading stocks, teased traders by finding support late in the week – a glimmer of hope, perhaps? While some stocks showed bullish buy signals, one must ponder if these are but a mirage, contingent on the market’s rebound efforts. Take Nvidia (NVDA), for instance. The AI chip leviathan managed to sprinkle a bit of fairy dust on investors by rebounding, meandering close to a buy point. Keen onlookers across Wall Street and Silicon Valley alike wait with bated breath, eyeing Nvidia’s prediction of a $100 billion free cash flow booster shot coming over the next two orbit cycles around the sun (that’s two years for us earthlings). Yet, the bond market hangs above like the sword of Damocles, with Treasury yields lounging around the 4% mark, compelling equities to nod along to its seemingly soporific tune. In this financial concert, knowing the lyrics to the bond market’s leading melody can mean the difference between crescendo and diminuendo in your investment portfolio.

2. Dreaming of Digital Gold: Bitcoin ETFs and the Crypto Rush

Next on the docket is cryptocurrency, that enigmatic digital darling that defies traditional financial gravity. The U.S. Securities and Exchange Commission (SEC), with its regulatory wand, may soon bestow its blessing upon the first spot bitcoin ETFs. Could this potentially ignite a bonfire of institutional involvement? Stay tuned. Meanwhile, Bitcoin has been waltzing through ups and downs, joined by crypto heavyweights such as CoinDesk (COIN) and Marathon Digital (MARA), all buzzing with the possibility of ETFs. CoinDesk, in a strategic chess move, eyes a corporate capture to expand Bitcoin derivatives in the European Union. A volatile dance, yet one where the tune of opportunity hums persistently in the background.

Next on the docket is cryptocurrency, that enigmatic digital darling that defies traditional financial gravity. The U.S. Securities and Exchange Commission (SEC), with its regulatory wand, may soon bestow its blessing upon the first spot bitcoin ETFs. Could this potentially ignite a bonfire of institutional involvement? Stay tuned. Meanwhile, Bitcoin has been waltzing through ups and downs, joined by crypto heavyweights such as CoinDesk (COIN) and Marathon Digital (MARA), all buzzing with the possibility of ETFs. CoinDesk, in a strategic chess move, eyes a corporate capture to expand Bitcoin derivatives in the European Union. A volatile dance, yet one where the tune of opportunity hums persistently in the background.

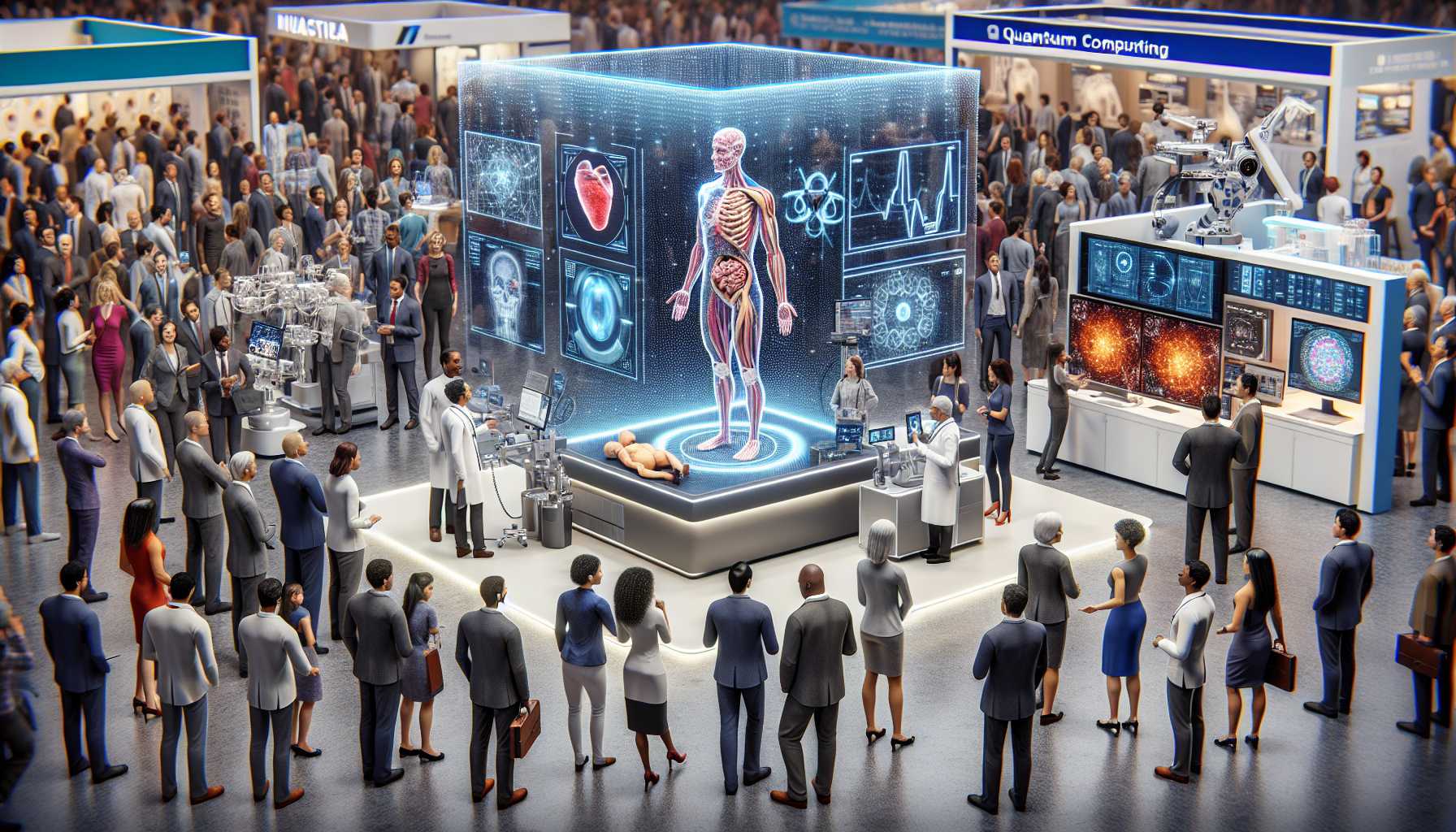

3. CES & JPMorgan Healthcare Conference: A Prelude to Big Tech Melodies

As CES and the JPMorgan Healthcare Conference gear up to set the stage, expect an aria of medical and technological innovations that may send reverberations throughout the market. Anticipation simmers as we count down to an earnings season featuring headliners such as JPMorgan Chase, Citigroup, and UnitedHealth. It is during these events that the beat drops – with the tech industry throwing its newest innovations into the spotlight while financial analysts crunch numbers and project trends within a symphony of data. Our eyes should be peeled for how Nvidia will showcase its latest GeForce RTX gaming chips, further cementing its position as a titanic player in both the tech innovation and investment spaces.

As CES and the JPMorgan Healthcare Conference gear up to set the stage, expect an aria of medical and technological innovations that may send reverberations throughout the market. Anticipation simmers as we count down to an earnings season featuring headliners such as JPMorgan Chase, Citigroup, and UnitedHealth. It is during these events that the beat drops – with the tech industry throwing its newest innovations into the spotlight while financial analysts crunch numbers and project trends within a symphony of data. Our eyes should be peeled for how Nvidia will showcase its latest GeForce RTX gaming chips, further cementing its position as a titanic player in both the tech innovation and investment spaces.

4. A VPN to Bypass Restrictions: ExpressVPN Enables RedTube Access

Stepping into somewhat murkier waters here, folks—internet freedom! With sites like RedTube facing geo-blockades in certain states, ExpressVPN emerges as the savior in a silicon cape. As an expert, I affirm the importance of personal privacy and digital rights, but I urge a balance between access and responsibility. A VPN can be a key to the castle, but every keyholder must proceed with wisdom.

Stepping into somewhat murkier waters here, folks—internet freedom! With sites like RedTube facing geo-blockades in certain states, ExpressVPN emerges as the savior in a silicon cape. As an expert, I affirm the importance of personal privacy and digital rights, but I urge a balance between access and responsibility. A VPN can be a key to the castle, but every keyholder must proceed with wisdom.

5. Twitch’s Tussle with Moderation: A Livestreaming Conundrum

Our digital society often struggles with the dark corners of its creation. Twitch’s difficulties with moderating its Clips feature is a sobering tale of innovation outpacing governance. As this platform evolves with aspirations to mirror TikTok’s content curation, one can only hope that it also escalates its efforts to protect its community, especially the youngest amongst us. It’s a stark reminder of our collective responsibility to foster a safe online environment while chasing the horizon of technological advances.

Our digital society often struggles with the dark corners of its creation. Twitch’s difficulties with moderating its Clips feature is a sobering tale of innovation outpacing governance. As this platform evolves with aspirations to mirror TikTok’s content curation, one can only hope that it also escalates its efforts to protect its community, especially the youngest amongst us. It’s a stark reminder of our collective responsibility to foster a safe online environment while chasing the horizon of technological advances.

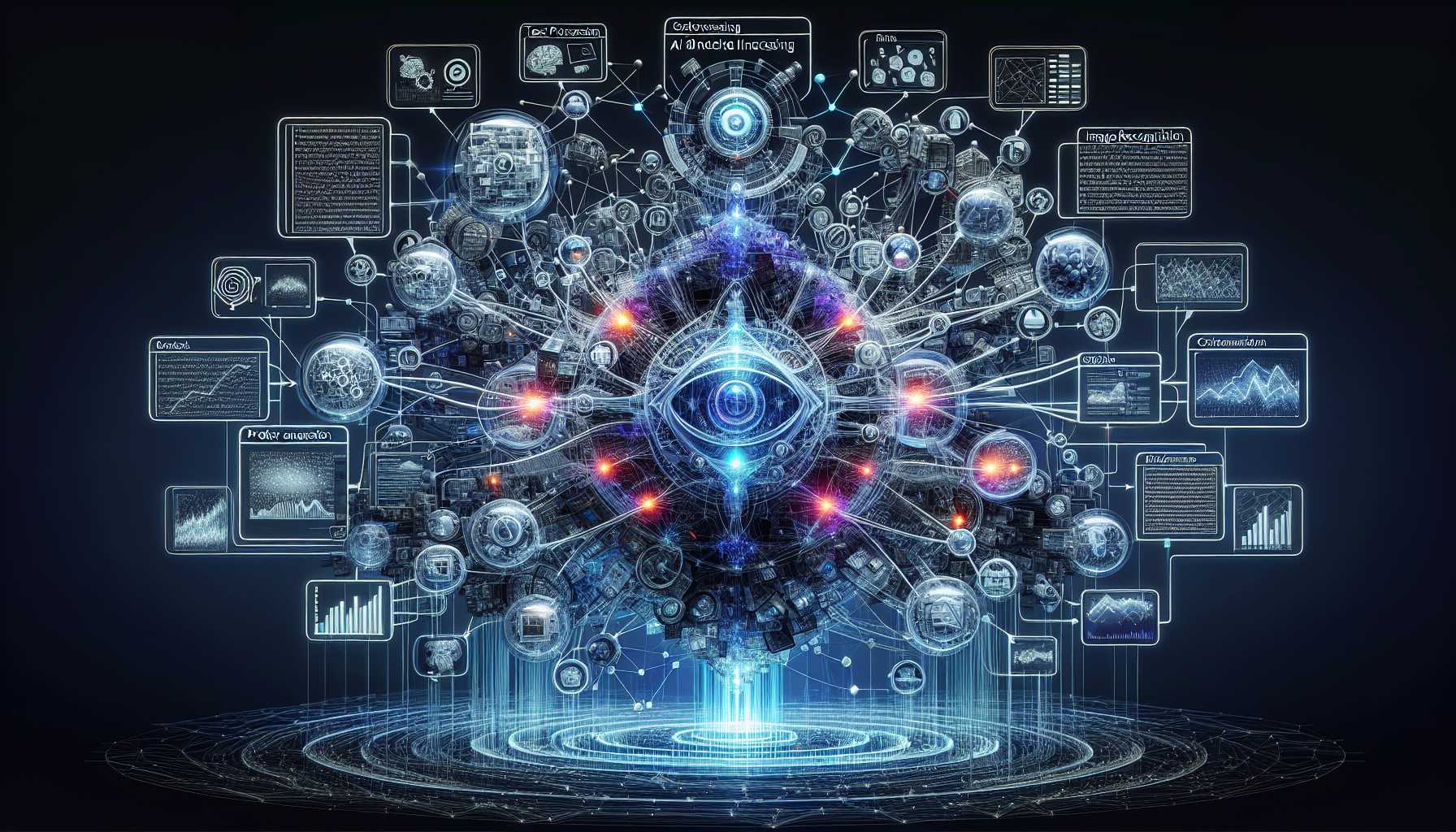

6. The Future Is Specialized: The AI Model Evolution

Let’s bring it back to tech-industry native tongue with a fascinating observation: the drifting from universal AI models like GPT-4 toward smaller, more focused, and efficient AI models resembles the hardware transition from CPUs to GPUs. It’s crystalline evidence of industry learning, adapting, and evolving. Our digital futurism isn’t just about the next big bang of invention; it’s about streamlining, refining, and directing technologies towards greater pragmatism and potency. As the tech industry’s maestro, I dare say that our industries’ dedication to purpose-built models and hardware will ring through the ages, cutting through the digital noise with striking clarity. It’s an era of specialized AI, folks—sleek, energy-efficient, and tailored for tasks, rather than a brute-force, one-size-fits-all juggernauts.

Let’s bring it back to tech-industry native tongue with a fascinating observation: the drifting from universal AI models like GPT-4 toward smaller, more focused, and efficient AI models resembles the hardware transition from CPUs to GPUs. It’s crystalline evidence of industry learning, adapting, and evolving. Our digital futurism isn’t just about the next big bang of invention; it’s about streamlining, refining, and directing technologies towards greater pragmatism and potency. As the tech industry’s maestro, I dare say that our industries’ dedication to purpose-built models and hardware will ring through the ages, cutting through the digital noise with striking clarity. It’s an era of specialized AI, folks—sleek, energy-efficient, and tailored for tasks, rather than a brute-force, one-size-fits-all juggernauts.

Closing Notes

We’ve sailed across choppy market seas and glimpsed upon digital horizons aglow with potential. It’s an extraordinary time to be alive, as technology and finance stand at the crossroads of human progress, where each decision, investment, and innovation echoes deep into the future. Stay bold, stay curious, and let’s keep this conversation alive—as we all play our part in scripting the future of this extraordinary, technologically spun symphony.