Introduction: Charting the AI Upsurge

Imagine a world where software bots efficiently manage your business finances, or where drilling technology optimizes oil production with a fraction of the rigs. Think of the possibilities of investing in companies on the brink of hitting the elusive trillion-dollar valuation or the implications of an AI revolution that could redefine employment and social structures. Welcome to the exceptional surge in artificial intelligence (AI) innovations and strategic investments that are redefining the tech industry and beyond, right before our eyes.

Imagine a world where software bots efficiently manage your business finances, or where drilling technology optimizes oil production with a fraction of the rigs. Think of the possibilities of investing in companies on the brink of hitting the elusive trillion-dollar valuation or the implications of an AI revolution that could redefine employment and social structures. Welcome to the exceptional surge in artificial intelligence (AI) innovations and strategic investments that are redefining the tech industry and beyond, right before our eyes.

The Finance Automation Frontier: Briq’s Bold Bot Brigade

While some startups squabble in a challenging funding environment, Briq—a platform automating financial workflows exclusive to the construction industry—soars higher in the ever-evolving tech sky. Navigating a different route, Briq raised $8 million at a flat $150 million valuation, a strategic move to reduce dilution and thrive amid the current market constraints. Providing a digital helm for construction companies through products like Briq AutoPilot and Briq CoPilot, the startup leverages AI with a library of over 200 generative automation bots—much like Tesla’s autopilot but for accounting. Briq’s technology streamlines processes such as accounts payable and forecasting, positioning it as a powerful contender in a historically human-driven field. Could this symbiosis of construction and AI set a new standard for industry efficiency?

While some startups squabble in a challenging funding environment, Briq—a platform automating financial workflows exclusive to the construction industry—soars higher in the ever-evolving tech sky. Navigating a different route, Briq raised $8 million at a flat $150 million valuation, a strategic move to reduce dilution and thrive amid the current market constraints. Providing a digital helm for construction companies through products like Briq AutoPilot and Briq CoPilot, the startup leverages AI with a library of over 200 generative automation bots—much like Tesla’s autopilot but for accounting. Briq’s technology streamlines processes such as accounts payable and forecasting, positioning it as a powerful contender in a historically human-driven field. Could this symbiosis of construction and AI set a new standard for industry efficiency?

Digital Onboarding’s Fintech Flourish

Another venture making strides in the financial sector is Digital Onboarding—a SaaS company designing an engagement platform for banks and credit unions. With an impressive $58 million capital injection from Volition Capital, Digital Onboarding is positioned to redefine customer engagement for financial institutions. The platform seeks to replace the archaic paper-based communication system with interactive, digital journeys that keep customers informed and engaged, potentially reducing the exodus of opened accounts. Embracing AI and machine learning for targeted communication, Digital Onboarding is an emblem of fintech innovation poised to reshape personal finance.

Another venture making strides in the financial sector is Digital Onboarding—a SaaS company designing an engagement platform for banks and credit unions. With an impressive $58 million capital injection from Volition Capital, Digital Onboarding is positioned to redefine customer engagement for financial institutions. The platform seeks to replace the archaic paper-based communication system with interactive, digital journeys that keep customers informed and engaged, potentially reducing the exodus of opened accounts. Embracing AI and machine learning for targeted communication, Digital Onboarding is an emblem of fintech innovation poised to reshape personal finance.

AI Infusion into Advertising: IPA Bellwether Report

Delving into the realm of marketing, the latest IPA Bellwether report highlights a surge in marketing budgets despite the financial downturn, underscoring the indelible mark of AI in advertising. Main media marketing budgets are climbing, and sectors like events and direct marketing are experiencing heightened attention. The industry is buzzing with opportunities as AI solutions emerge to meet the challenges imposed by cookie deprecation and misinformation. Companies are increasingly harnessing AI for contextual targeting, risk detection, and consumer engagement, which forecasts a brighter horizon for strategic marketing investments.

Delving into the realm of marketing, the latest IPA Bellwether report highlights a surge in marketing budgets despite the financial downturn, underscoring the indelible mark of AI in advertising. Main media marketing budgets are climbing, and sectors like events and direct marketing are experiencing heightened attention. The industry is buzzing with opportunities as AI solutions emerge to meet the challenges imposed by cookie deprecation and misinformation. Companies are increasingly harnessing AI for contextual targeting, risk detection, and consumer engagement, which forecasts a brighter horizon for strategic marketing investments.

Stock Surges and Splits: Tesla and The Trade Desk

Zooming into the stock market, Tesla and The Trade Desk stand tall as behemoths of investment returns, thanks to their stock splits. These companies not only symbolize the shareholder value in AI but also substantiate substantial upside potential as projected by certain Wall Street analysts. Their focus on AI-driven products and services—from Tesla’s self-driving software to The Trade Desk’s advertising technology—underscores a shared vision of continued excellence and innovation.

Zooming into the stock market, Tesla and The Trade Desk stand tall as behemoths of investment returns, thanks to their stock splits. These companies not only symbolize the shareholder value in AI but also substantiate substantial upside potential as projected by certain Wall Street analysts. Their focus on AI-driven products and services—from Tesla’s self-driving software to The Trade Desk’s advertising technology—underscores a shared vision of continued excellence and innovation.

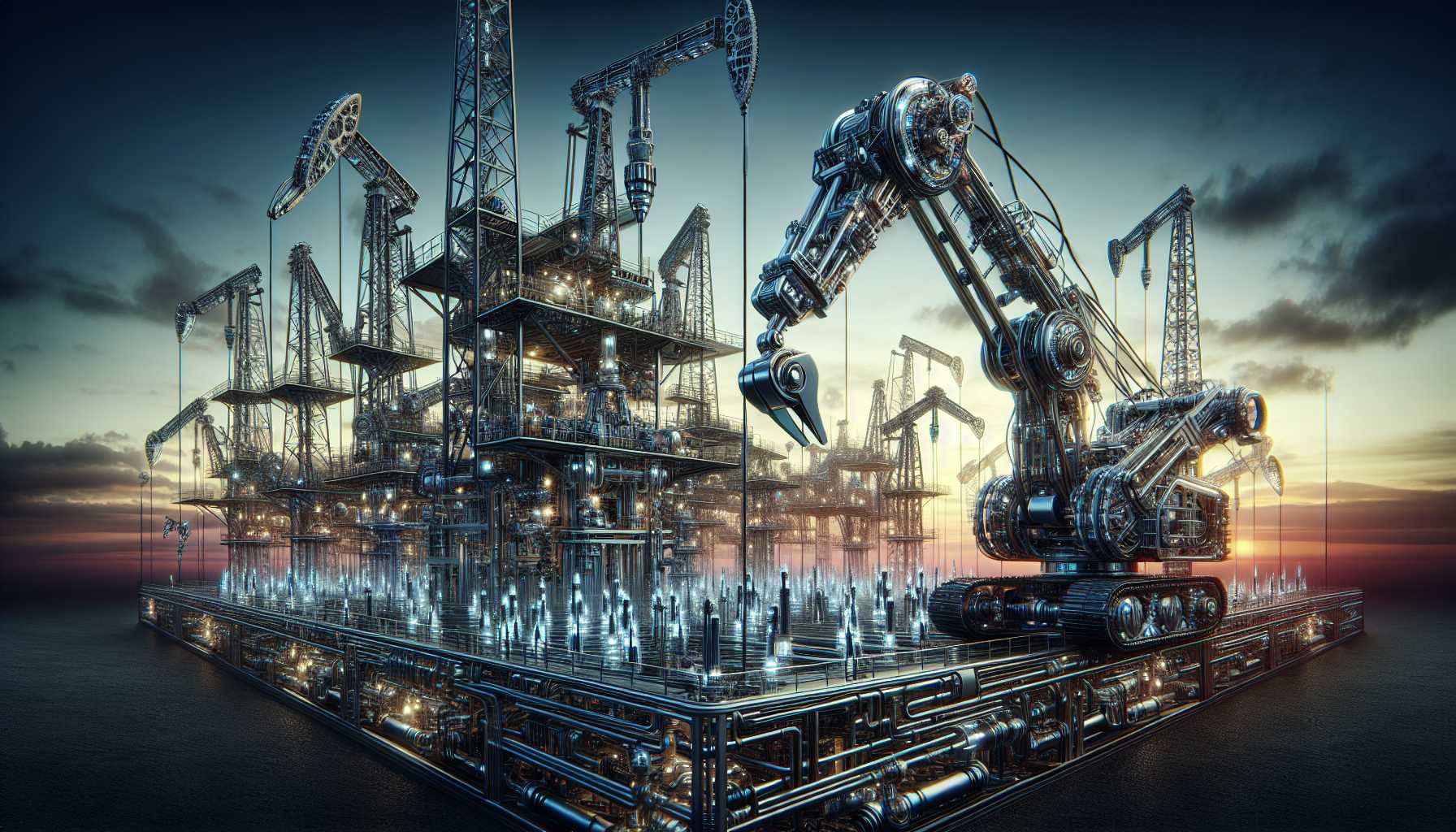

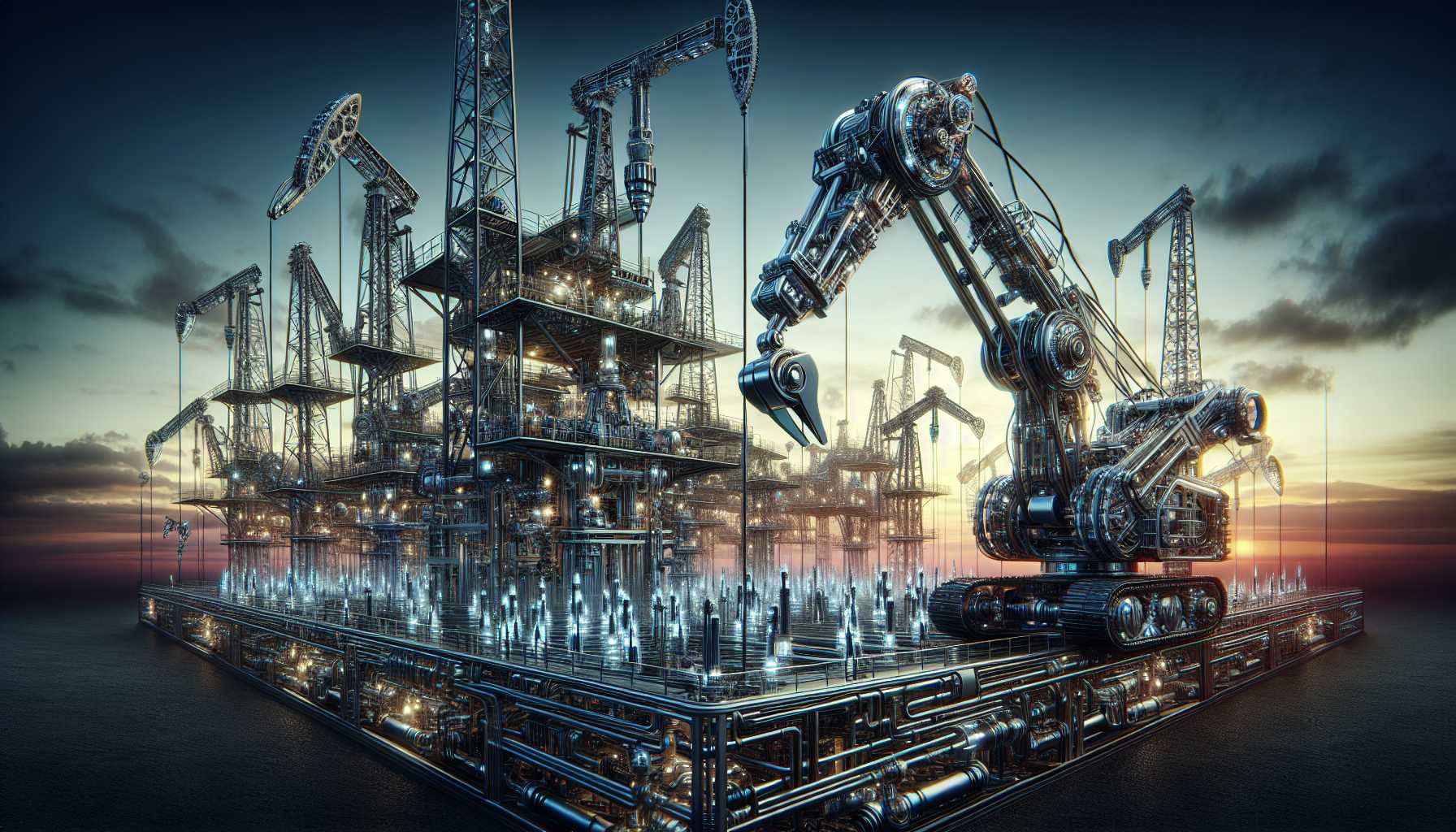

Oil Patch Productivity: The AI-Driven Drilling Evolution

In an impressive feat of efficiency, U.S. oil production sustains historic highs with significantly fewer drilling rigs, thanks to AI and advanced drilling techniques. Companies are implementing AI and machine learning to optimize exploration and production processes, using fewer resources to achieve greater yields. This technological leap not only showcases AI’s prowess in traditional sectors but also hints at a transformative future for the energy industry.

In an impressive feat of efficiency, U.S. oil production sustains historic highs with significantly fewer drilling rigs, thanks to AI and advanced drilling techniques. Companies are implementing AI and machine learning to optimize exploration and production processes, using fewer resources to achieve greater yields. This technological leap not only showcases AI’s prowess in traditional sectors but also hints at a transformative future for the energy industry.

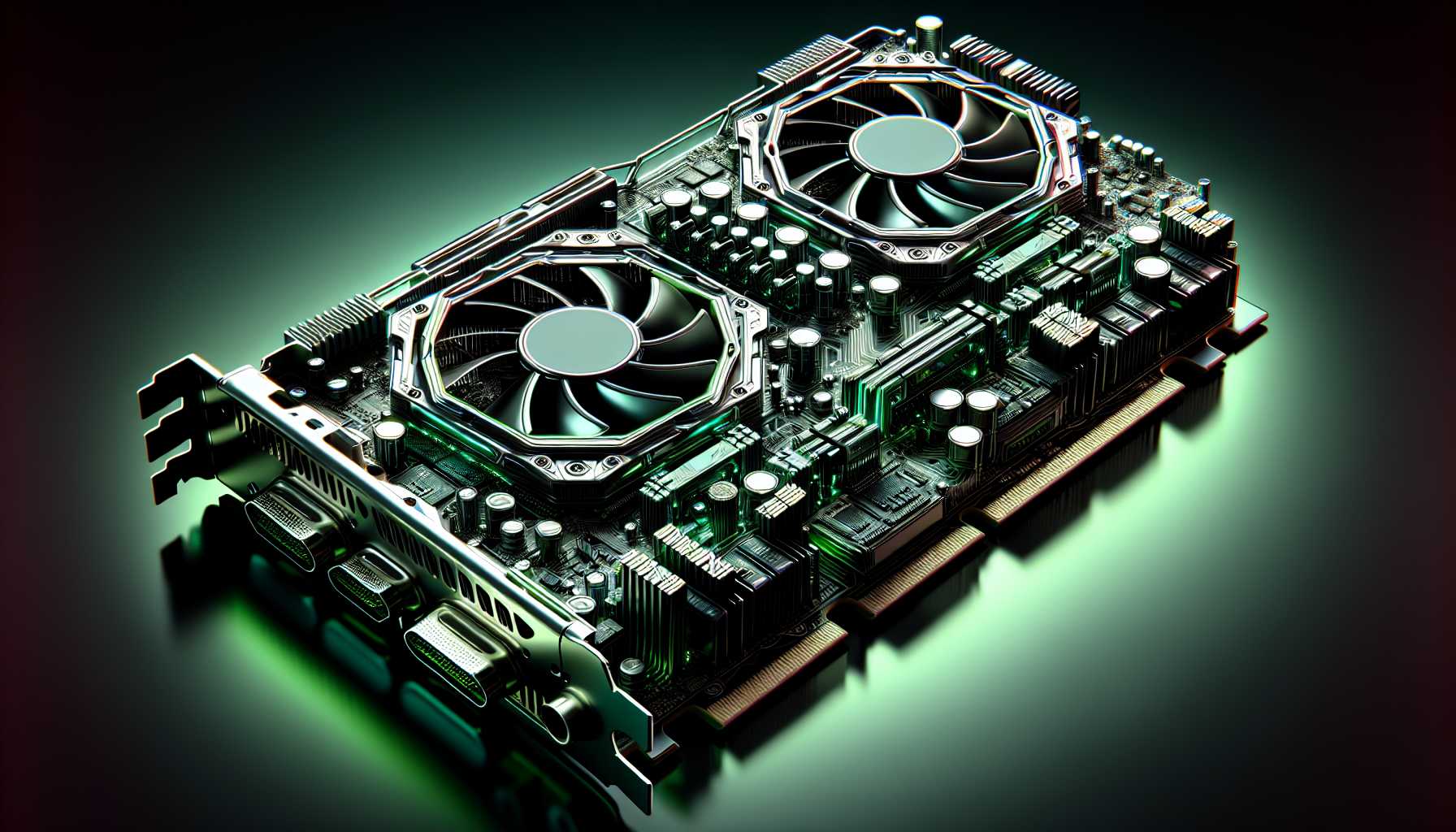

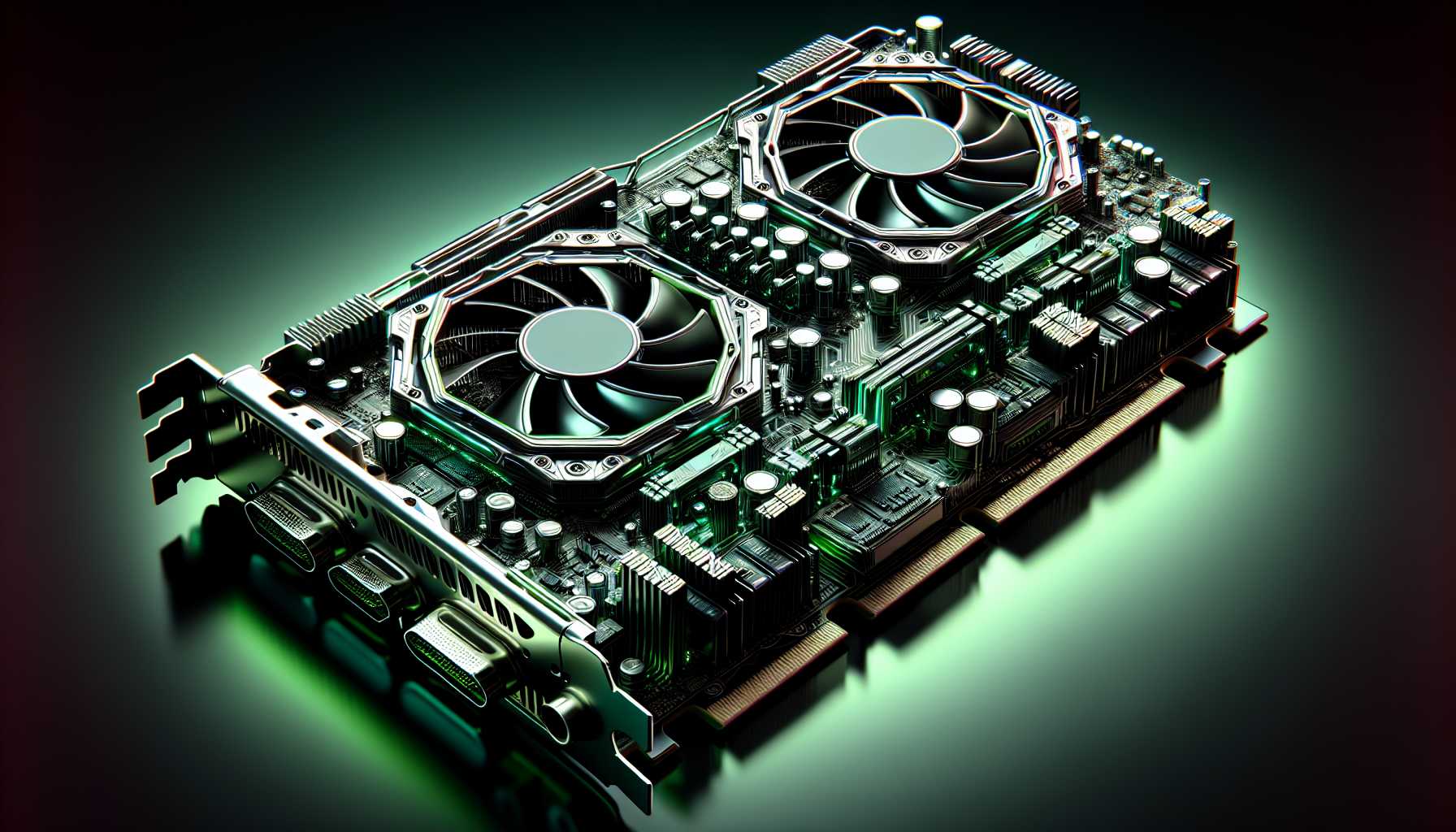

AI Investing: Nvidia’s Noteworthy Niche

Nvidia’s unwavering dominance in AI chip technology has sparked a formidable surge in its stock price, making it a stellar AI investment beacon. The pioneering role of Nvidia’s graphics cards in training large language models elevates it to a tech titan status. Though the stock is soaring at premium valuations, its lead in AI innovation provides fertile ground for continued growth and investment allure.

Nvidia’s unwavering dominance in AI chip technology has sparked a formidable surge in its stock price, making it a stellar AI investment beacon. The pioneering role of Nvidia’s graphics cards in training large language models elevates it to a tech titan status. Though the stock is soaring at premium valuations, its lead in AI innovation provides fertile ground for continued growth and investment allure.

Zooming In On AI Enrichment: Zoom and Confluent

Zoom Video Communications and Confluent stand out as potential beneficiaries of the AI boom. Zoom’s venture into AI-enhanced video conferencing promises to reinvigorate its position in the tech landscape, while Confluent’s real-time data streaming platforms cater to AI application development across industries. Investors looking beyond the likes of Nvidia for AI investment opportunities might consider these companies as their stock offerings present a blend of value and growth potential.

Zoom Video Communications and Confluent stand out as potential beneficiaries of the AI boom. Zoom’s venture into AI-enhanced video conferencing promises to reinvigorate its position in the tech landscape, while Confluent’s real-time data streaming platforms cater to AI application development across industries. Investors looking beyond the likes of Nvidia for AI investment opportunities might consider these companies as their stock offerings present a blend of value and growth potential.

Towards a Trillion: The Bank of America and Advanced Micro Devices

The trillion-dollar valuation, a remarkable milestone in corporate history, appears within striking distance for some underdogs. Bank of America and Advanced Micro Devices (AMD) are two such candidates, with the former positioned for an upswing in economic climates and the latter poised to capitalize on the AI processing market against stiff competition. These companies might just join the trillion-dollar club by the end of this decade, reflecting the transformative impact of strategic choices and burgeoning market opportunities.

The trillion-dollar valuation, a remarkable milestone in corporate history, appears within striking distance for some underdogs. Bank of America and Advanced Micro Devices (AMD) are two such candidates, with the former positioned for an upswing in economic climates and the latter poised to capitalize on the AI processing market against stiff competition. These companies might just join the trillion-dollar club by the end of this decade, reflecting the transformative impact of strategic choices and burgeoning market opportunities.

AI’s Impact Beyond Tech: An IMF Perspective

Finally, the International Monetary Fund (IMF) provides a sobering view of AI’s societal implications. With AI predicting substantial shifts in global employment dynamics, the technology poses both opportunities for increased productivity and risks of exacerbated inequality. As countries grapple with differing levels of AI preparedness, the onus lies on policymakers to navigate the challenges and harness AI’s potential for equitable growth. The AI revolution is not merely confined to the corridors of tech companies; it is a pervasive force reshaping businesses, financial practices, and the global socioeconomic fabric. As tech enthusiasts and industry observers, we’re witnessing an extraordinary chapter of innovation where the risks are high, the rewards potentially higher, and the need for strategic foresight imperative.

Finally, the International Monetary Fund (IMF) provides a sobering view of AI’s societal implications. With AI predicting substantial shifts in global employment dynamics, the technology poses both opportunities for increased productivity and risks of exacerbated inequality. As countries grapple with differing levels of AI preparedness, the onus lies on policymakers to navigate the challenges and harness AI’s potential for equitable growth. The AI revolution is not merely confined to the corridors of tech companies; it is a pervasive force reshaping businesses, financial practices, and the global socioeconomic fabric. As tech enthusiasts and industry observers, we’re witnessing an extraordinary chapter of innovation where the risks are high, the rewards potentially higher, and the need for strategic foresight imperative.