The Fastest Unicorn: Krutrim’s AI Ambition

Artificial Intelligence (AI) is more than just a buzzword in the tech landscape; it’s a revolutionary force, and Krutrim is its newest champion. Established by Bhavish Aggarwal, founder of Ola, this AI startup has not just pranced but galloped its way to unicorn status at breakneck speed. Becoming the fastest unicorn in India and the first Indian AI startup to join the club is no mean feat. But what really spices up the story is Krutrim’s focus on indigenous AI, particularly its large language model trained in local Indian languages—a move that mirrors the diversity and linguistic uniqueness of India. Keep an eye on Krutrim’s voice-enabled conversational AI. It could be the next big thing in tech, fostering unprecedented inclusivity by bridging language barriers.

Artificial Intelligence (AI) is more than just a buzzword in the tech landscape; it’s a revolutionary force, and Krutrim is its newest champion. Established by Bhavish Aggarwal, founder of Ola, this AI startup has not just pranced but galloped its way to unicorn status at breakneck speed. Becoming the fastest unicorn in India and the first Indian AI startup to join the club is no mean feat. But what really spices up the story is Krutrim’s focus on indigenous AI, particularly its large language model trained in local Indian languages—a move that mirrors the diversity and linguistic uniqueness of India. Keep an eye on Krutrim’s voice-enabled conversational AI. It could be the next big thing in tech, fostering unprecedented inclusivity by bridging language barriers.

Abundance in the AI Gold Rush

Investors are rallying behind the potential of AI like prospectors during the gold rush. While Warren Buffett might not buy a company solely for its AI prospects, Berkshire Hathaway’s portfolio indicates a strategic move towards AI-centric firms. Companies like Snowflake, Amazon, Coca-Cola, and even Apple are embedding AI into their core, pushing boundaries beyond traditional business models. Snowflake’s AI virtual assistant, Amazon’s AI-driven large language model, Coca-Cola’s AI-formulated drink, and Apple’s AI-fortified chips point to one truth—the AI wave is reshaping industries, and early adopters may reap exponential rewards.

Investors are rallying behind the potential of AI like prospectors during the gold rush. While Warren Buffett might not buy a company solely for its AI prospects, Berkshire Hathaway’s portfolio indicates a strategic move towards AI-centric firms. Companies like Snowflake, Amazon, Coca-Cola, and even Apple are embedding AI into their core, pushing boundaries beyond traditional business models. Snowflake’s AI virtual assistant, Amazon’s AI-driven large language model, Coca-Cola’s AI-formulated drink, and Apple’s AI-fortified chips point to one truth—the AI wave is reshaping industries, and early adopters may reap exponential rewards.

Chip Titans Redefining Value

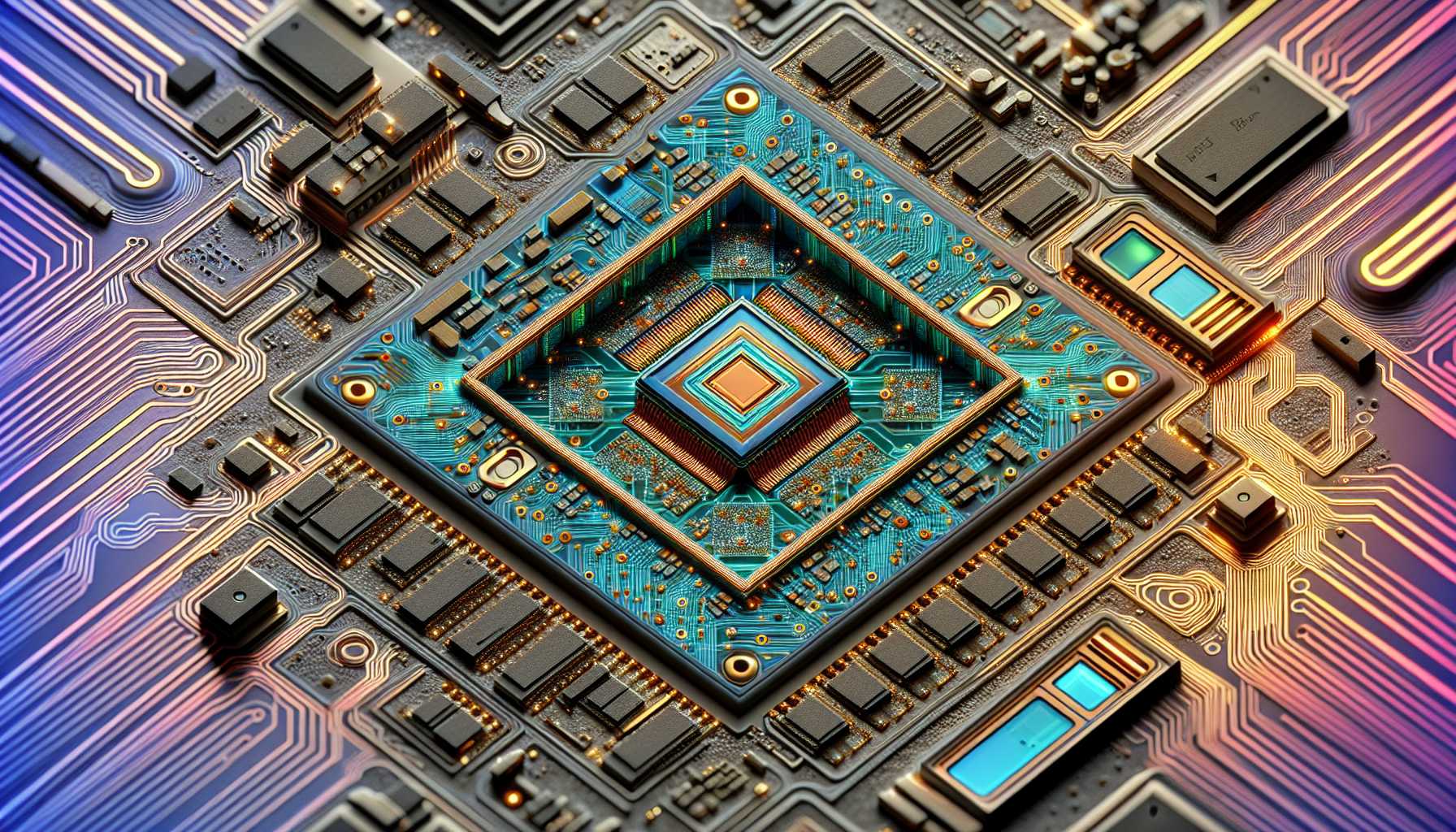

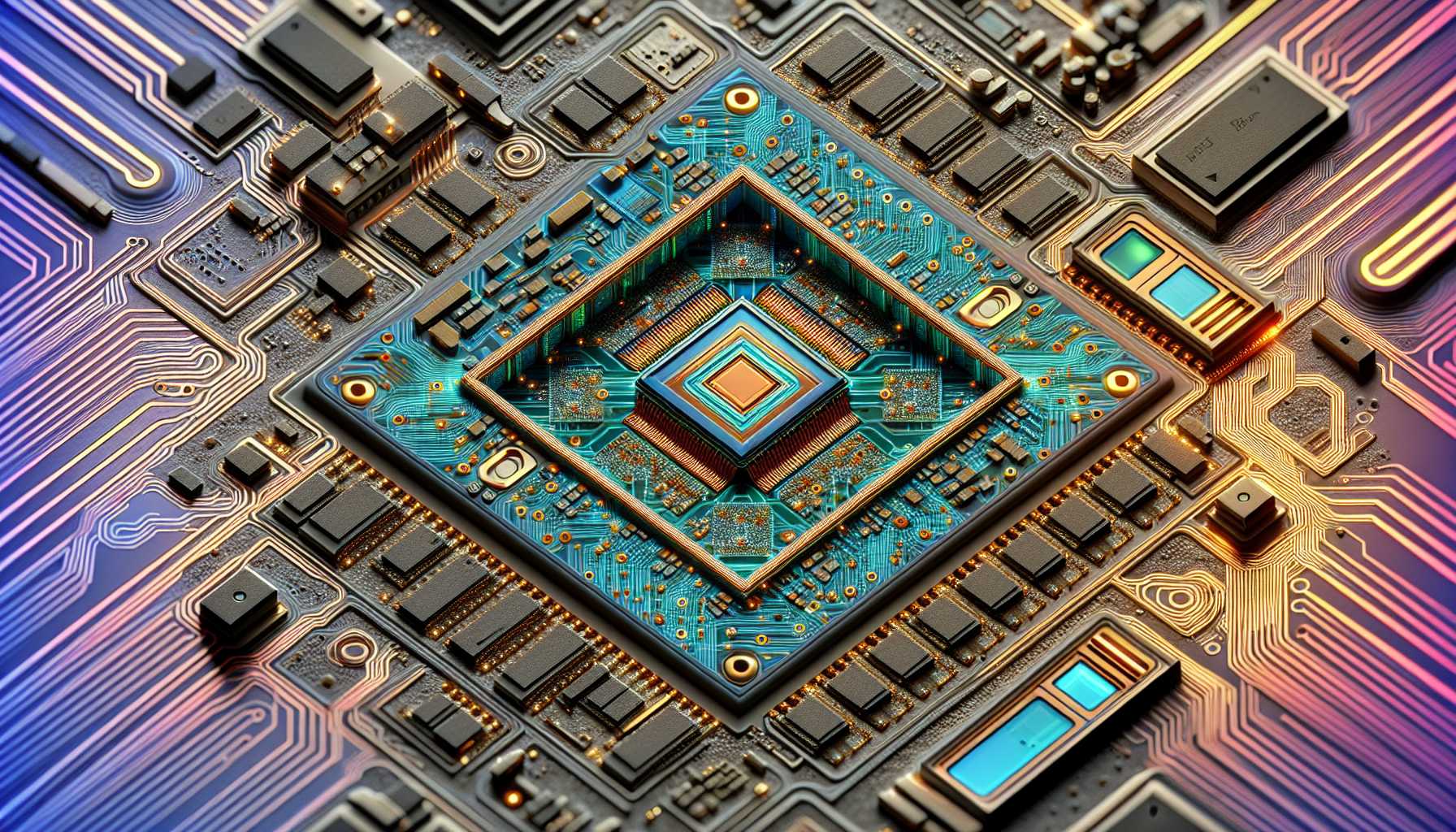

Amid surging semiconductor stocks, Nvidia emerges as a juggernaut, securing its spot as the fifth-most-valuable U.S. company. Yet, amidst this fanfare for chips and AI’s influencing role in their valuation, Taiwan Semiconductor Manufacturing (TSMC) steals the spotlight as a prime contender. Its effective business model and advancement in nano-chip technology beckon savvy investors. TSMC exemplifies a brilliant strategy—rising tides lift all boats, making it a coveted pick in an unpredictable market where semiconductors are the new kings.

Amid surging semiconductor stocks, Nvidia emerges as a juggernaut, securing its spot as the fifth-most-valuable U.S. company. Yet, amidst this fanfare for chips and AI’s influencing role in their valuation, Taiwan Semiconductor Manufacturing (TSMC) steals the spotlight as a prime contender. Its effective business model and advancement in nano-chip technology beckon savvy investors. TSMC exemplifies a brilliant strategy—rising tides lift all boats, making it a coveted pick in an unpredictable market where semiconductors are the new kings.

Investing in AI’s Promising Trio

Casting our investor’s eye further, we spot three AI stocks that signal robust potential: Advanced Micro Devices, Microsoft, and Nvidia. Each plays a significant role in carrying the AI torch forward, with their unique strategies and tech advances shaping the future landscape. When contemplating investment, one can’t ignore the surge in AI’s influence across industries—making these stocks not just attractive but perhaps essential for a forward-thinking portfolio.

Casting our investor’s eye further, we spot three AI stocks that signal robust potential: Advanced Micro Devices, Microsoft, and Nvidia. Each plays a significant role in carrying the AI torch forward, with their unique strategies and tech advances shaping the future landscape. When contemplating investment, one can’t ignore the surge in AI’s influence across industries—making these stocks not just attractive but perhaps essential for a forward-thinking portfolio.

ETFs: The Prudent Path in AI and Semiconductors

For those choosing a more passive investment journey, ETFs like the VanEck Semiconductor ETF offer a diversified gateway into the semiconductor industry without fixating on individual stocks. The ETF mirrors the burgeoning potential of semiconductors fueled by AI, revealing an underlying truth—consistent innovation in this sector promises a future where passive investment strategies can potentially generate generational wealth.

For those choosing a more passive investment journey, ETFs like the VanEck Semiconductor ETF offer a diversified gateway into the semiconductor industry without fixating on individual stocks. The ETF mirrors the burgeoning potential of semiconductors fueled by AI, revealing an underlying truth—consistent innovation in this sector promises a future where passive investment strategies can potentially generate generational wealth.

The Impact of Tech Layoffs on Startups

On a somber note, tech layoffs have become an all-too-common headline. However, for startups, especially those in AI-related fields, this trend presents an opportunity. As top talent becomes available, agile startups can inject new expertise and innovation into their veins, potentially accelerating their growth and solidifying their competitive edge in a turbulent market.

On a somber note, tech layoffs have become an all-too-common headline. However, for startups, especially those in AI-related fields, this trend presents an opportunity. As top talent becomes available, agile startups can inject new expertise and innovation into their veins, potentially accelerating their growth and solidifying their competitive edge in a turbulent market.

Cathie Wood’s Investment Appetite

Cathie Wood, a household name in investment circles, has been actively reshaping her Ark Invest portfolios. Her selective buying spree—stocking up on companies like Meta Platforms, Recursion Pharmaceuticals, and Ginkgo Bioworks—highlights a strategic emphasis on AI and biotech. These moves point to the continuing marriage of tech and biotech, an area ripe for investment as the world leans heavily on tech for solutions in health and beyond.

Cathie Wood, a household name in investment circles, has been actively reshaping her Ark Invest portfolios. Her selective buying spree—stocking up on companies like Meta Platforms, Recursion Pharmaceuticals, and Ginkgo Bioworks—highlights a strategic emphasis on AI and biotech. These moves point to the continuing marriage of tech and biotech, an area ripe for investment as the world leans heavily on tech for solutions in health and beyond.

The Surge of Skill-Based Gaming

Moving away from the usual roster of tech topics, Skill Money Games introduces an AI-driven platform revolutionizing skill-based gaming within the indoor golf market. As they prep for a national expansion in 2024, it’s a testament to how AI isn’t just about data and numbers—it’s about enhancing experiences and pioneering new ways to game and compete.

Moving away from the usual roster of tech topics, Skill Money Games introduces an AI-driven platform revolutionizing skill-based gaming within the indoor golf market. As they prep for a national expansion in 2024, it’s a testament to how AI isn’t just about data and numbers—it’s about enhancing experiences and pioneering new ways to game and compete.

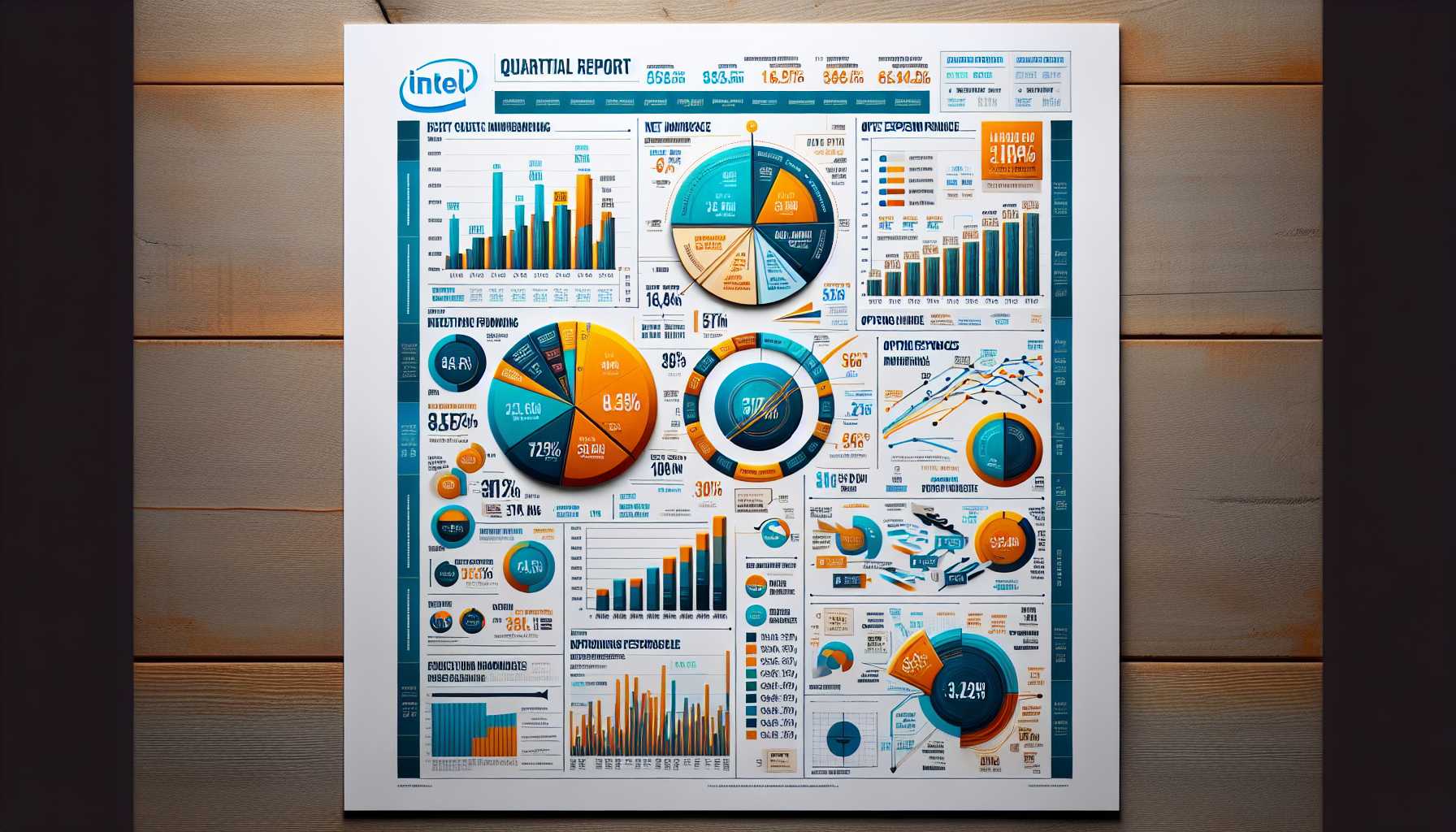

Insights from the Quarterly Reports

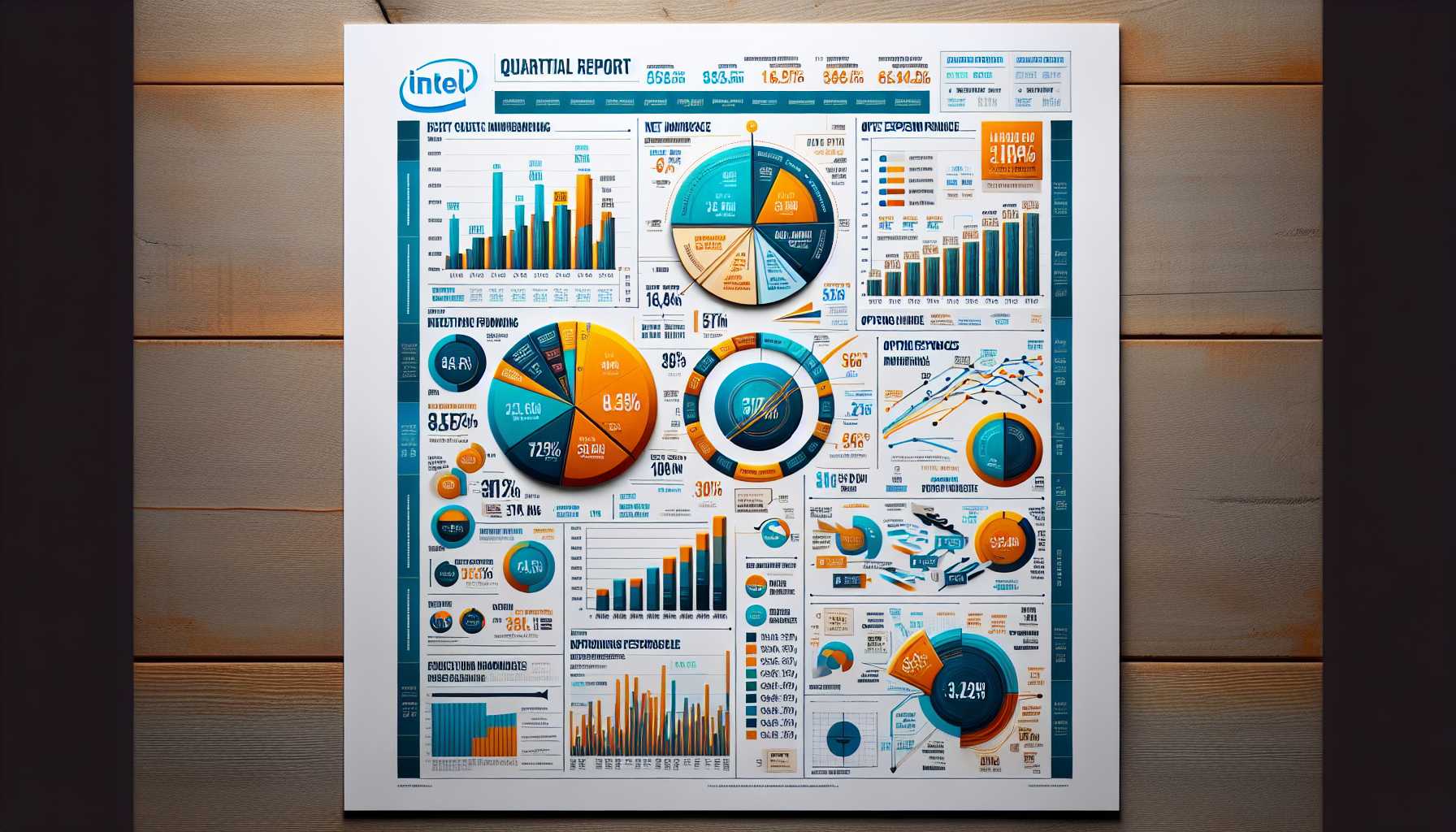

An investor’s outlook isn’t complete without a peek into quarterly financials. Intel’s report serves as a gauge for the health of the chip industry, indicating future trends and challenges. As they navigate supply constraints and geopolitical tensions, Intel’s playbook offers valuable lessons for tech startups and investors alike—stay nimble, innovate, and keep an eye on the long game.

An investor’s outlook isn’t complete without a peek into quarterly financials. Intel’s report serves as a gauge for the health of the chip industry, indicating future trends and challenges. As they navigate supply constraints and geopolitical tensions, Intel’s playbook offers valuable lessons for tech startups and investors alike—stay nimble, innovate, and keep an eye on the long game.

Nintendo’s Next Move: A Gaming Power Play?

Lastly, whispers of a new Nintendo Switch with an 8-inch LCD screen signal that the gaming colossus is ready for another disruptive play, potentially as early as this holiday season. As the gaming industry eagerly anticipates Nintendo’s response to the next-gen consoles by Sony and Microsoft, this move could redefine the handheld gaming market and present an enticing opportunity for those wanting a share of the gaming pie. In conclusion, from AI unicorns to chip titans, ETFs to gaming disruptors, the tech investment landscape is as dynamic and rich as ever. To thrive in this environment requires foresight, a willingness to embrace emerging tech trends, and an understanding of the broader market implications. Whether you’re an avid investor or a tech enthusiast, staying informed and agile is key to capturing the multifaceted opportunities that lie ahead in this thrilling era of technological advancement.

Lastly, whispers of a new Nintendo Switch with an 8-inch LCD screen signal that the gaming colossus is ready for another disruptive play, potentially as early as this holiday season. As the gaming industry eagerly anticipates Nintendo’s response to the next-gen consoles by Sony and Microsoft, this move could redefine the handheld gaming market and present an enticing opportunity for those wanting a share of the gaming pie. In conclusion, from AI unicorns to chip titans, ETFs to gaming disruptors, the tech investment landscape is as dynamic and rich as ever. To thrive in this environment requires foresight, a willingness to embrace emerging tech trends, and an understanding of the broader market implications. Whether you’re an avid investor or a tech enthusiast, staying informed and agile is key to capturing the multifaceted opportunities that lie ahead in this thrilling era of technological advancement.