Cathie Wood’s Tenacity Pays Off in 2023

Investment virtuoso Cathie Wood, known for her unwavering belief in disruptive technologies, has once again proved her prowess in the high-stakes casino of the stock market. After a rollercoaster ride in recent years, Wood and Ark Invest have outperformed the market in 2023. Now, as we march into 2024, Wood remains undeterred by a shaky start and is doubling down on her bets. She’s not just playing the game; she’s live-streaming her playbook—publishing daily trades and keeping nothing but an open ledger between her strategy and anyone savvy enough to follow along.

The Big Three: Palantir, Tesla, and Intellia Therapeutics

Wood’s recent shopping spree encompassed bolstering her stakes in Palantir (PLTR), Tesla (TSLA), and Intellia Therapeutics (NTLA). But this isn’t about shopping with abandon—it’s about strategic investing. Wood is notorious for buying the dip, yet in a bold move, she snapped up Palantir shares on a day the stock soared by a meteoric 31%. This aligns with the ethos of seizing artificial intelligence (AI) stocks, a segment that surged last year. Palantir shrugged off its initial image as a mere government contractor to vaunt a staggering 70% revenue increase in the U.S. commercial sector. Meanwhile, Tesla faced rough tides with a stock tumble of 26% in 2024, but for Wood, this is merely a chapter in a longer saga of innovation and EV dominance. And Intellia Therapeutics? Despite being in its clinical prime and down 87% from its peak three years ago, Wood’s investment suggests a belief in a genetic-editing future that could make today’s valuations a speck in the rearview mirror.

UiPath’s AI and Automation Highwire Act

UiPath (PATH), a titan in the AI and robotic process automation (RPA) industry, is springboarding out of Palantir’s shadow as it teases the market with a potential breakout. Top money managers, spreading their bets across a bevy of enterprise software firms, seem bullish on PATH’s 140% earnings growth. As Microsoft, SAP, and Amazon Web Services court UiPath’s partnership, this growth narrative emboldens the idea that mundane tasks of today will be tales of automation tomorrow. Moreover, UiPath’s rally doesn’t stand alone. It’s part of a broader tableau with peers like ServiceNow, Salesforce, and Shopify, all surfacing as institutional darlings. Investors, entreated by such tales of AI and automation ingenuity, will watch eagerly as PATH aims for a breakout with the same gusto as its software seeks to revolutionize productivity across sectors.

Sky’s Not the Limit for Skyworks Solutions

Nvidia’s stock has soared to the stratosphere, becoming the poster child for AI-reliant investors. But those looking earthward might find their eyes landing on Skyworks Solutions (SWKS), famed for its iPhone components and now poised to ride the AI wave at a more grounded valuation. An anticipated AI boom in smartphones could be the jolt Skyworks needs, with generative AI technologies potentially transforming its fortunes—and its stock along with it. As Skyworks’ RF semiconductors find a place in a kaleidoscope of markets, its pivot towards AI-enabled products, symbiotic with Apple’s innovative drive, could herald prosperous times ahead. Discounting Skyworks today could be the oversight investors talk about tomorrow, as generative AI’s inclusion in smartphones revolutionizes the very device that lives in our pockets.

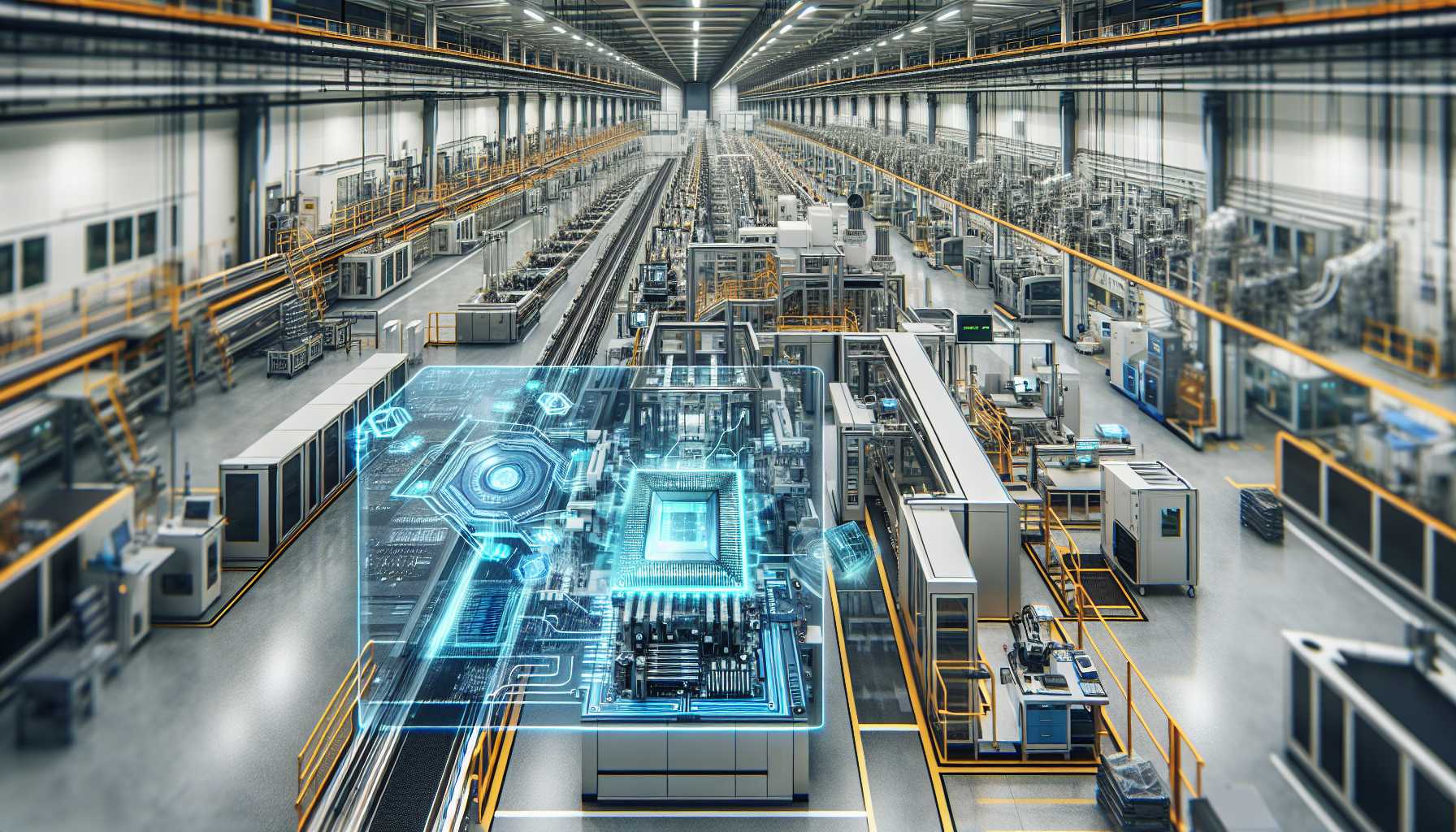

Taiwan Semiconductor Manufacturing: A Juggernaut in High Demand

Taiwan Semiconductor Manufacturing (TSM) walks into 2024 on a victory lap. With January revenues up by an admirable 8% year over year and a burgeoning demand for its wares, TSM is at the epicenter of the AI app development arms race—a race that necessitates the very chips it crafts. It’s not just profit sheets that make headlines for TSM; the company’s expansion into Japan, backed by Sony Semiconductor Solutions, Toyota, and Denso, extends its influence and assures a demand that matches its own ambitious growth. As Taiwan Semi asserts its dominance in the semiconductor sphere, its position as a vital cog in the tech world’s machinery looks to become ever more unassailable. For tech investors, TSM’s power moves signal a stock that’s not just about numbers—it’s about holding the keys to the kingdom of tomorrow’s AI-driven economy.

In closing, while these tech narratives weave dense webs of financial and technical intricacies, they share a common thread: profound faith in technological progress that’s bold, disruptive, and boundless. For enthusiasts in the realm of tech investing, this is less a market update and more an epic saga of human ingenuity that’s only just beginning to unfold.