Mobile Banking in South Africa: A Growing Trend

Introduction

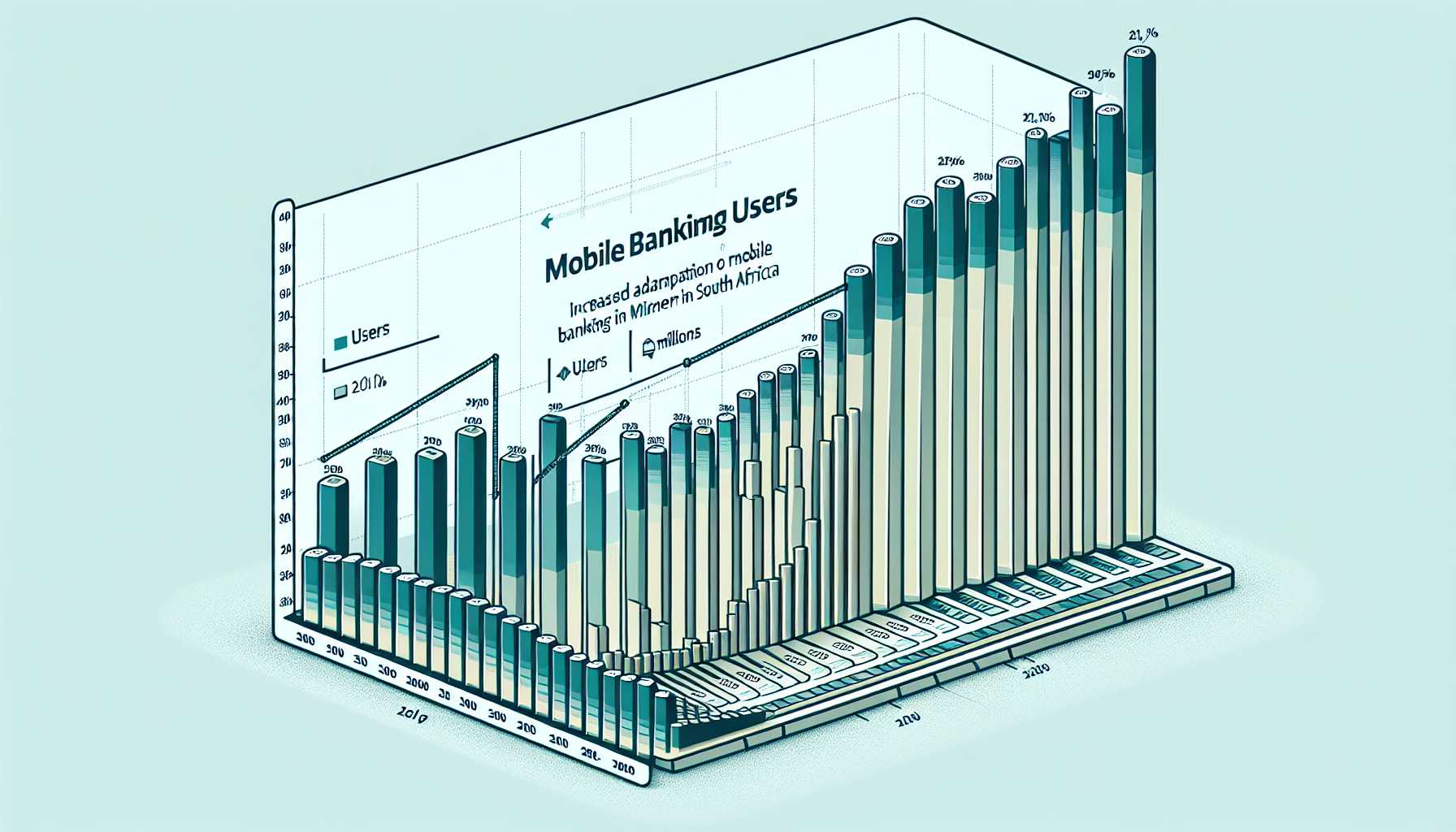

Mobile banking has become increasingly popular in South Africa in recent years. As of 2023, there are an estimated 25 million mobile banking users in the country, which represents approximately 60% of the adult population. This growth is being driven by a number of factors, including the increasing availability of smartphones, the growing popularity of mobile internet, and the increasing convenience and security of mobile banking apps.

Benefits of Mobile Banking

There are a number of benefits to using mobile banking apps, including:

Convenience

Mobile banking apps allow you to bank from anywhere, at any time. You can check your balance, transfer funds, pay bills, and more, all from your smartphone.

Security

Mobile banking apps are very secure. They use a variety of security measures to protect your personal and financial information, including encryption, two-factor authentication, and fraud monitoring.

Time-saving

Mobile banking apps can save you a lot of time. You can avoid having to go to a bank branch or ATM, and you can bank whenever it’s convenient for you.

How to Use Mobile Banking

To use mobile banking, you’ll need to download a mobile banking app from your bank. Once you’ve downloaded the app, you’ll need to create an account and link it to your bank account. Once your account is set up, you can start using the app to bank from your smartphone.

Conclusion

Mobile banking is a convenient, secure, and time-saving way to bank. If you’re not already using mobile banking, I encourage you to give it a try. You may be surprised at how much easier it makes banking.