Mobile Banking in Japan: A Growing Trend

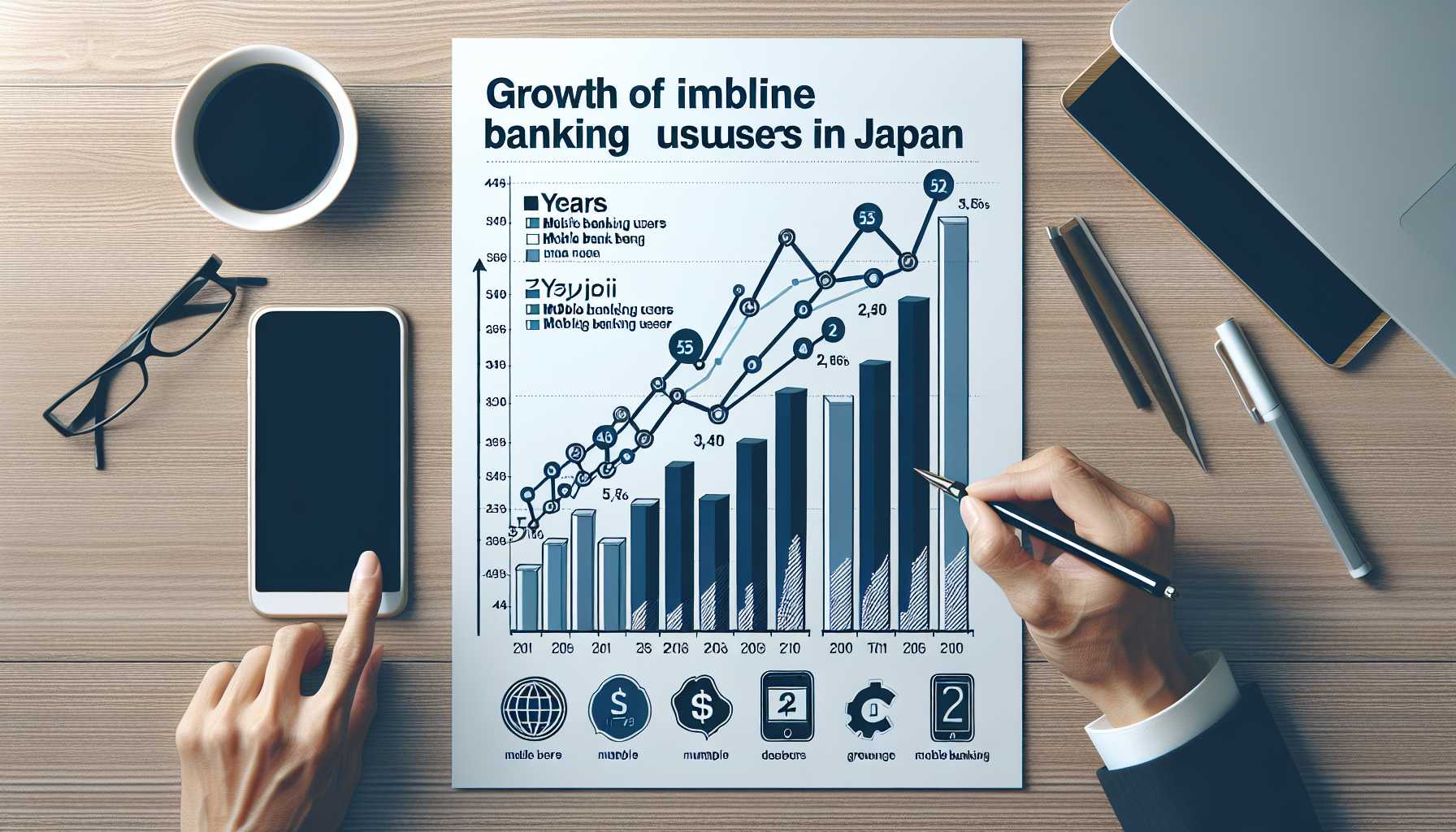

Mobile banking has become increasingly popular in Japan in recent years, as more and more people adopt smartphones and tablets. According to a survey by the Bank of Japan, the number of mobile banking users in Japan reached 84.1 million in 2021, up from 77.2 million in 2020. This represents a penetration rate of 66.4%, which is higher than the global average of 63.3%.

Factors Contributing to the Growth of Mobile Banking in Japan

- Increased availability of high-speed internet access: This has made it easier for people to access their bank accounts online.

- Growing popularity of e-commerce: This has made it more convenient for people to make payments online using their mobile devices.

Benefits of Mobile Banking

- Convenience: Users can access their bank accounts anytime, anywhere.

- Security: Mobile banking is generally considered secure, with banks using various security measures to protect customer data.

- Cost-effectiveness: Mobile banking is often free or low-cost, saving users money on bank fees.

Conclusion

The number of mobile banking users in Japan is growing rapidly due to its convenience, security, and cost-effectiveness. This trend is expected to continue as more people adopt smartphones and tablets.