The Rise of Artificial Intelligence: A Tech Odyssey

The tech world is abuzz with a term that sounds like a sci-fi fantasy, but it’s as real as it gets: Artificial Intelligence (AI). From the labyrinthine data realms of Palantir Technologies to the sleek designs of Apple products, AI is the ethereal force powering the next wave of innovation.

AI Titans: Palantir Technologies Vs. Microsoft

Ark Investment Management’s influential CEO, Cathie Wood, sparked conversations amongst investors when she suggested Palantir Technologies could not only play ball with Microsoft in the AI landscape but potentially outrun the tech behemoth. Palantir’s rise is fueled by not only its burgeoning AI platform but also its clever lead generation via immersive bootcamps, revealing to onlookers precisely how AI can escalate their data-driven decisions. With a 44% increase in commercial customers, skepticism is giving way to palpable excitement about Palantir’s expanding empire.

On the other side of the ring stands Microsoft, the 800-pound gorilla of the tech world, which has made substantial investments in OpenAI’s ChatGPT. But Palantir is undaunted. This David versus Goliath scenario could unfold across the board, catalyzing innovation in an already effervescent market and highlighting how focused AI endeavors are no longer the relegated to the sidelines in corporate strategies.

Warren Buffett and the AI Investment Extravaganza

The term ‘extraordinary’ falls from the lips of Warren Buffett when contemplating AI, and his investments reflect this sentiment. Buffett’s diversified portfolio boasts significant stakes in companies such as Apple, Amazon, and Microsoft, all of which have AI baked into their operations. With substantial returns over the years, these investments underscore the fundamental impact AI technology is making across sectors, from e-commerce to cloud services and beyond.

Buffett’s AI stock selection is a nod to the strategic significance of incorporating AI into the fabric of a company’s ecosystem to fuel growth, expand services, and ultimately wield the algorithmic power of AI to stay ahead of the curve.

Sam Altman’s AI Odyssey: Investing in the Future

Sam Altman, CEO of OpenAI, with his Midas touch in tech investment, has navigated the choppy waters of the tech ocean with alacrity. His vested interests in companies like Reddit, Airbnb and Uber, along with AI innovations such as ChatGPT, Dall-E, and Sora, paint a portrait of an investing wizard with an eye not just for surface ripples but for the deep currents of tech that reshape our world. Each prowess-filled story, from Reddit’s AI training data affluence to Airbnb’s market dominance, whispers of savvy moves and foresights into the unfolding AI chapter of human history.

Cathie Wood’s AI Investment “Reality Check”

Cathie Wood’s perspective on AI investments is a blast of cold, rational air on the fever-pitched excitement surrounding AI in stocks. The euphoria, pushing Nasdaq and S&P 500 to record heights, is built upon what Wood describes as a narrow channel of tech giants, the “Magnificent Seven” monopolizing significant market movements. Yet, Wood cautions investors, not all that’s AI glitters with guaranteed returns. In the sea of AI enthusiasm, Wood’s insights work as a lighthouse for investors eager to dabble in AI waters. She urges a filter for the dazzling lights—a need for scrutinizing business results over sector hype.

Spring Cleaning the Tech Stock Portfolio

The spring season is the perfect metaphor for tech investors to weed out stocks and sow seeds in promising ventures. Some argue Apple, with its stagnant iPhone sales and concerns about staying competitive in an AI-first world, might need to be plucked from portfolios. Others like C3.ai, despite its AI gloss, may face challenges related to profitability and growth, urging a cautious retreat. Conversely, high-flying companies with inflated stock prices, such as Super Micro Computer, may tempt investors to capitalize on gains before market volatility kicks in, proving that not all tech growth is perennial.

The Ripple Effect of Micron Technology’s Success

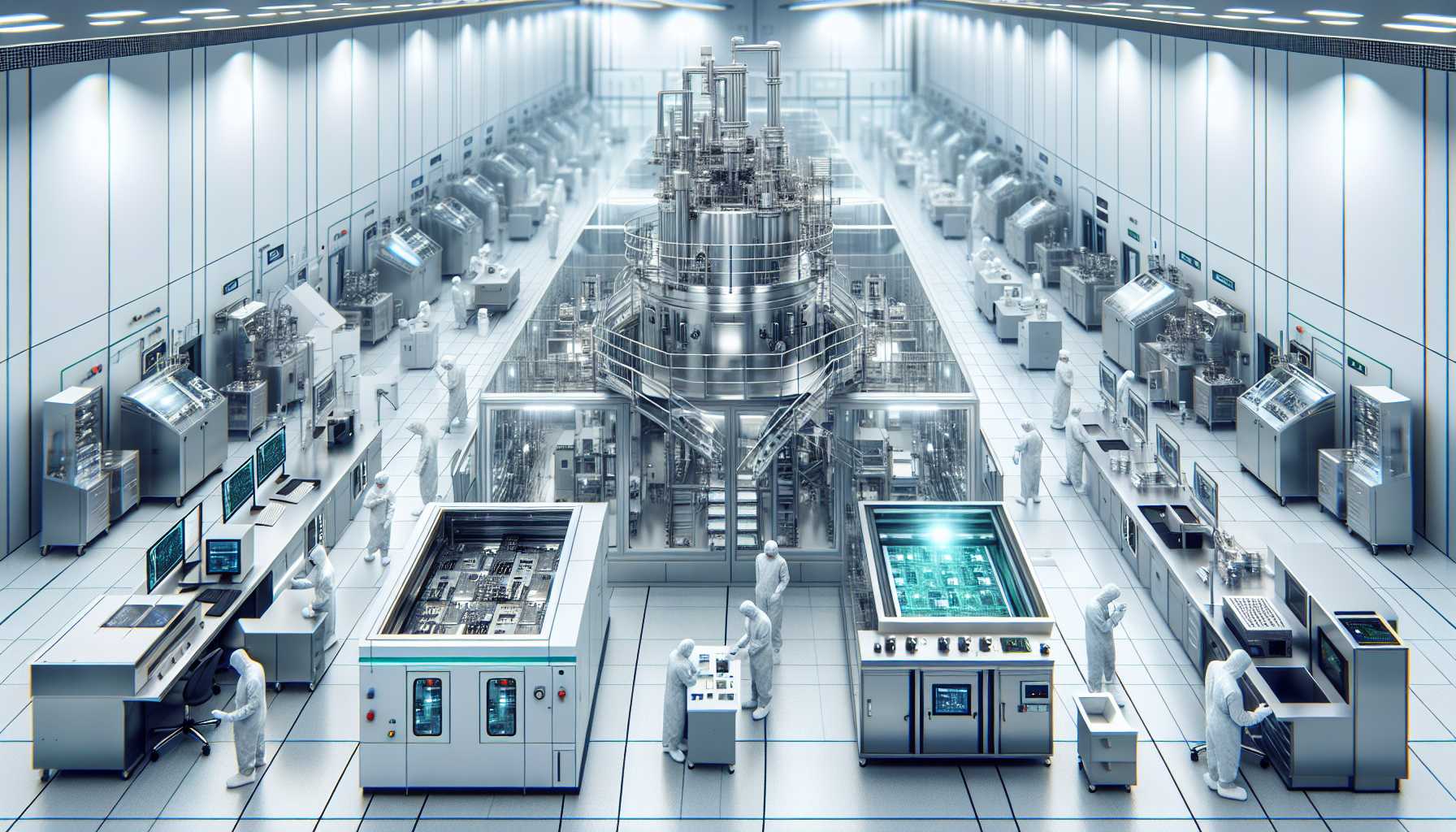

Lam Research could be the under-the-radar benefactor of Micron Technology’s soaring success in memory chip demand, indicative of the interconnected web of the tech industry where one company’s breakthrough often heralds fortune for its partners. Micron’s sale of high-bandwidth memory paints a glowing picture for semiconductor equipment manufacturers, who are integral to the chip-making process that powers this AI-driven resurgence. Micron’s AI-infused prosperity is a testament to a larger narrative where AI’s spur to memory enhancements and creation energizes the entire supply chain, forecasting prosperous tides for specialized tech enablers.

Seated at the intersection of prophecies and practicality, the AI-centered tech revelations, stirring in the cauldron of expert opinions and market movements, unveil a scene where potential mingles with caution. As AI reshapes the firmament of technology, the ballad of ‘tech-morrow’ is being composed today—and it promises a symphony both grand and intricate.

the intersection of prophecies and practicality, the AI-centered tech revelations, stirring in the cauldron of expert opinions and market movements, unveil a scene where potential mingles with caution. As AI reshapes the firmament of technology, the ballad of ‘tech-morrow’ is being composed today—and it promises a symphony both grand and intricate.