The Tech Arena’s Pivotal Shifts: Windows 10’s End and FinTech’s Evolving Landscape

The End is Nigh: Windows 10 Extended Support Unveiled

Windows 10’s Swan Song: ESUs and the March Toward the Future

With a nostalgic farewell, Microsoft has announced the end of support for Windows 10 on October 14th, 2025. However, Extended Security Updates (ESUs) offer a lifeline for users, allowing them to continue using Windows 10 with paid protection.

This move acknowledges the reality that many users are deeply rooted in the Windows 10 experience. ESUs reflect the understanding that legacy systems, like trusted tomes, are not easily relinquished.

Pricing Strategy: The Enterprise Edge and Educational Easing

Businesses will face a tiered pricing model for ESUs, ranging from $61 to $244 per year. However, discounts are available through cloud-based services like Intune and Windows Autopatch.

Educational organizations receive a substantial discount, with ESUs starting at just $1. This recognizes the financial constraints often faced by educational institutions.

The Reluctant Pivot to Windows 11 and the Consumer Conundrum

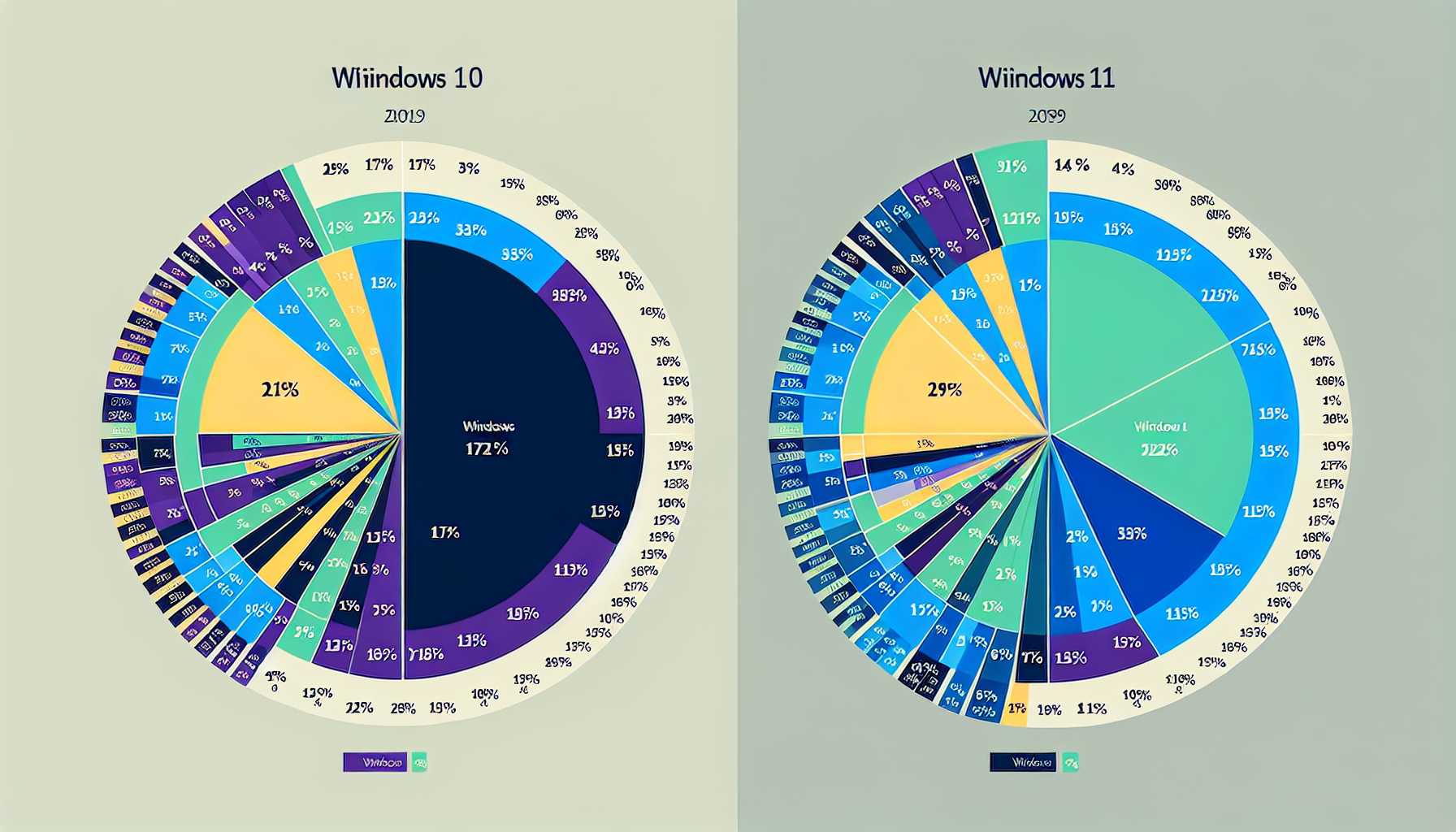

Encouraging a migration to Windows 11 has met with apprehension due to hardware requirements. This reluctance is reflected in the tepid adoption rate of Windows 11 compared to the juggernaut introduction of Windows 10.

Microsoft will need to address the hardware limitations faced by consumers to facilitate a smoother transition to Windows 11.

FinTech’s Changing Fortune: A Y Combinator Cohort Analysis and Global Investments

Fintech’s Fickle Tide: Analyzing Startup Trajectories

Y Combinator’s demo days reveal a decline in fintech representation, from one-quarter to just 8%. This suggests a shift in innovation trends, with cross-border fintech gaining traction.

Fintech is experiencing a natural oscillation, a product lifecycle arc that emphasizes the need for reinvention.

Fintech Funding Forecast: A Cool Breeze in Q1

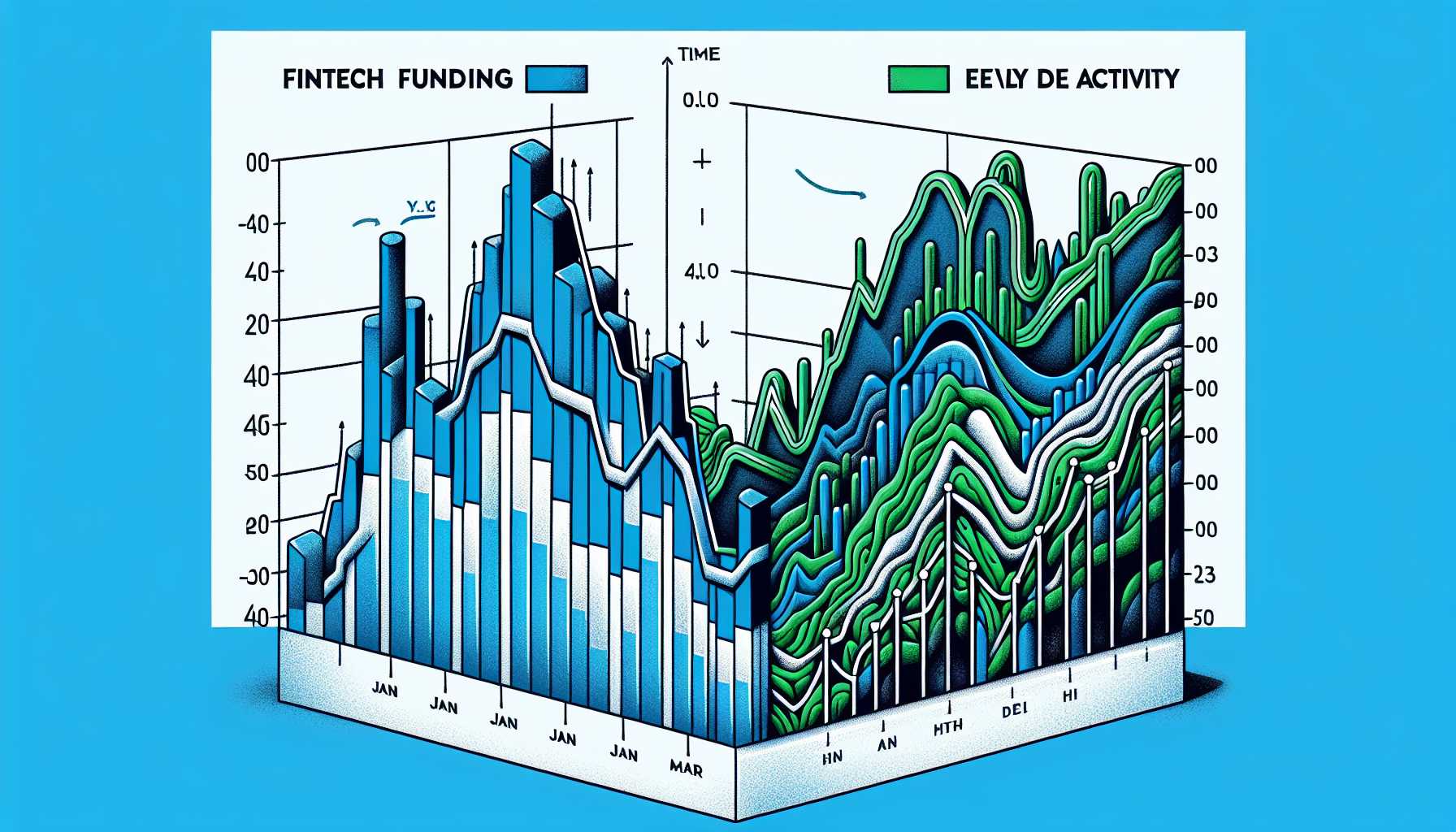

A decline in fintech funding in Q1, the lowest since early 2017, may raise concerns. However, an uptick in equity deal-making indicates an undercurrent of enduring interest.

This resilience suggests optimism and persistence amidst economic challenges. Payments technology remains a strong performer within the fintech sector.

Gold’s Glittering Enigma Amid Geopolitical Gyrations

The Enigmatic Ascent of Gold: A Conundrum Beyond Rates and Retrenchments

Gold prices have surged amid geopolitical strife and economic uncertainty. This rally challenges traditional safe haven narratives and highlights the interconnectedness of market movements.

Gold’s ascent underscores the complex interplay of factors that drive market surges and shifts in consumer and investor behaviors.

The Halving of Bitcoin: A Cryptic Crypto Eclipse

Bitcoin’s Halving Hype: Illuminating the Crypto Eclipse

Bitcoin’s halving event, which reduces the reward for mining new blocks, has sparked speculation. Historical patterns suggest a potential surge in value, but skepticism is warranted.

From an economic perspective, the halving could lead to a price increase due to reduced supply growth and steady demand. However, the crypto market remains volatile and subject to unexpected shifts.

Conclusion

The tech and financial arenas are constantly evolving, with pivotal shifts and emerging trends. From the end of Windows 10 support to the fluctuations in fintech and the enigmatic rise of gold, the landscape is ever-changing.

These developments underscore the interconnectedness of markets and the need for adaptability. As the tech and financial worlds continue to evolve, we witness the pulsating rhythm of innovation, investment, and expectation.