The Dawn of Dextrous Droids:

Man’s quest for creating automatons that mimic human actions and intellect isn’t new. But when Microsoft, a vanguard of innovation, steers a colossal $675 million investment toward Figure—a Bay Area robotics haven—we know the AI-driven humanoid robotics revolution is nascence.

Here, in the heart of Silicon Valley, these pioneers are crafting not just robots, but potential kindred with cognitive capabilities akin to humans, evoking images of science fiction that may soon breach the borders of fantasy into reality.

The humanoid Phoenix, powered by Microsoft’s collaboration with Sanctuary AI, flaunts not only a broader scope of motion but an impending intellect equitable to ours—a thought-provoking concept that scrambles the conventional circuitry of traditional robotics.

As tech connoisseurs, we are tethered to the trajectory of such evolution. It’s the caliber of tech prophecy Bill Gates himself mused over, and the likes of Agility and Apptronik are laboring tirelessly to bring to our daily lives.

This fascination isn’t isolated to Microsoft; OpenAI is planting stakes in both Figure and competitor 1X, reflecting a strategy not unlike the tech colossus itself.

Midwest Venture Capital’s Marvelous Momentum:

Away from the coast’s Silicon hub, Midwest venture capital firms like Hyde Park Venture Partners (HPVP) are crafting their own tech epicenters. Securing $98 million in fresh capital commitments for Fund IV, HPVP admonishes the “fly-over” city moniker, touting a treasure chest of approximately $320 million that fuels innovation and entrepreneurial spirit in America’s heartland.

This bold chapter not only showcases the region’s thirst for tech prosperity but also highlights remarkable milestones. The mammoth surge of logistics company ShipBob eyeballs an IPO, testament to HPVP’s unerring knack for backing unicorns.

With the Midwest cementing its position as a crucible for startups—fueled by an amalgamation of university ingenuity and federal R&D funds—it’s a stark reminder that innovation isn’t confined to coastal citadels but rather blooms where it’s fostered.

Tesla’s Turbulence and Supercharger Strategy:

Amidst automakers vamping their EV escapades with Tesla’s Supercharger network, an unforeseen disbandment of Tesla’s Supercharger team by Elon Musk sets the industry abuzz. This pivot sends ripples through GM and Ford, staunch collaborators counting on Supercharger’s network ubiquity.

Contrastingly, Musk, synonymous with unorthodox stratagems, propounds a slower Supercharger expansion with unyielding commitment to uptime and expansion of extant locales. An enigmatic move by one who has his chip stacked on AI and robotics—perhaps signaling a reconfiguration of Tesla’s trajectory to align with Musk’s AI-first ethos.

AI Investment: The Decisive Decades Ahead:

When investment titans like Nvidia, Snowflake, and Palantir Technologies pivot toward AI capabilities, it’s less about jumping on a trend and more about strategic foresight. AI, once nestled in the realms of academia and niche application, now beckons a transformative shift in industries across the board—from data analytics to defense.

The staggering AI chip market share commanded by Nvidia, the data commoditization by Snowflake, and Palantir’s turnkey applications illustrate a collective march towards an AI-driven epoch. It’s a competitive theatre where every incremental advancement in AI is not merely an upgrade but a stride towards dominance in a potential trillion-dollar arena.

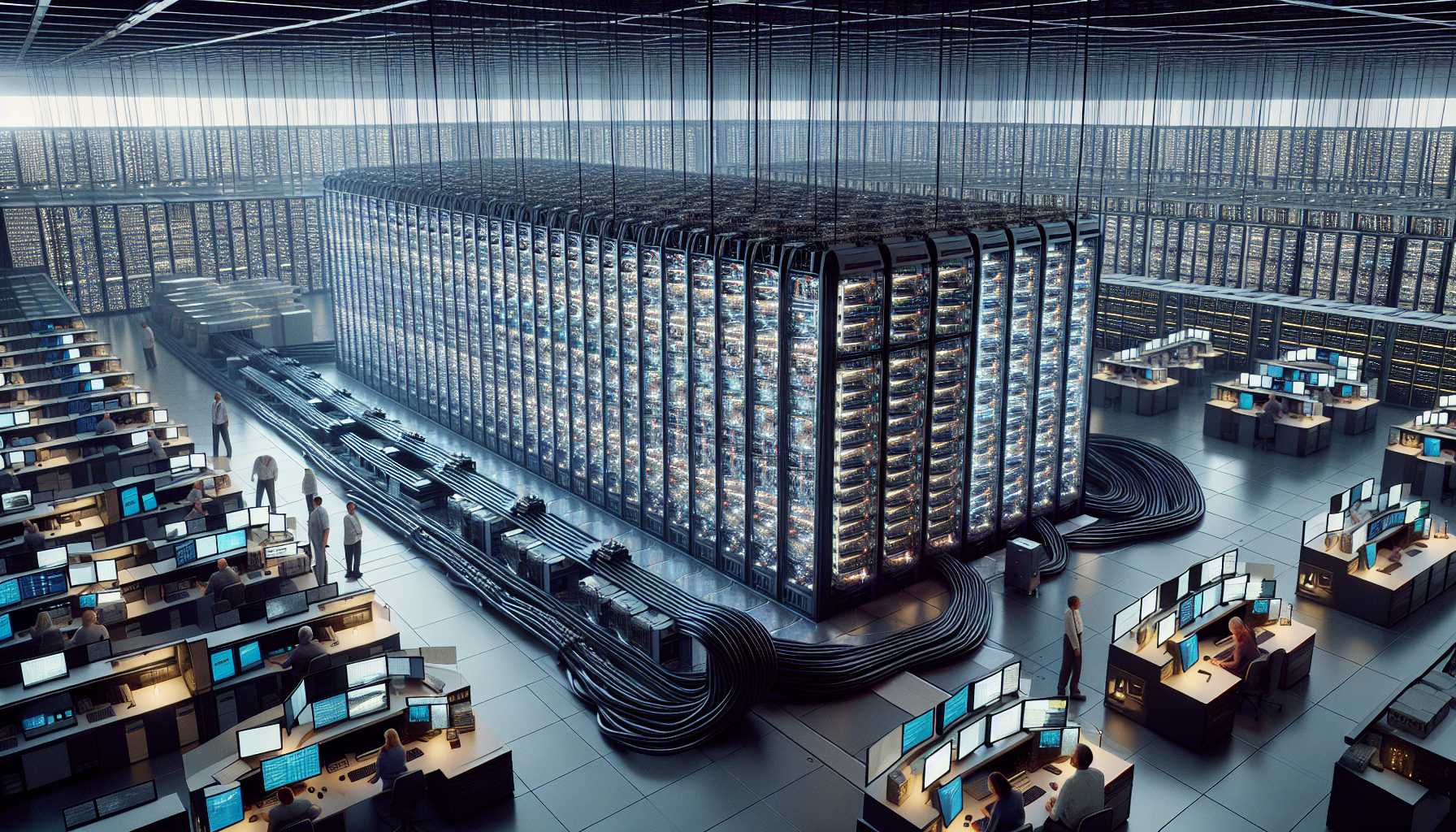

A Supercomputing Steal: Uncle Sam Auctions Cheyenne:

In a startling twist, the U.S. government puts the Cheyenne Supercomputer, a formidable 5.34-petaflop behemoth, on the auction block. It’s an offering that would pique any Big Data enthusiast’s interest.

With a core count soaring over 145,000 and memory in the realm of terabytes, it conjures visions of computational conquests within reach, albeit with no CAT5/6 cables included. What’s perplexing is seeing such a titan, once the fulcrum of climate and hurricane research, now reduced to a government bargain possibly due to water spray malfunctions and unrepaired nodes.

Yet, it heralds an intriguing question—could this auction signal a shift in federal priorities or simply a cycle of technology refresh? As we keenly observe this auction’s outcome, it is a stark reminder of technology’s ephemeral dominance—the relentless march toward more advanced and efficient machines forges on.

In conclusion, from AI’s permeation into chip manufacturing to Microsoft’s robotics escapade and the Midwest boom, the tech landscape is in constant flux. As investors, we look towards these industry shifts for harbingers of where the next windfall bet lies. Our eyes remain peeled on the evolution unfolding in every chip, code, and venture dollar allocated.