Berkshire Hathaway Annual Meeting: A New Dawn Without Charlie Munger

Berkshire Hathaway Annual Meeting: A New Dawn Without Charlie Munger

#

A New Dawn at Berkshire Hathaway’s Annual Extravaganza

The vibrant city of Omaha recently played host to an event that’s nothing short of a financial festivity—the Berkshire Hathaway annual shareholder meeting. However, this year’s assembly embarks on a poignant chapter: it’s the first sans the legendary Charlie Munger, who left us with a treasure trove of wisdom at the age of 99.

As I tuned in (along with countless others across the globe), it wasn’t just the glossy presentations or the overflow of savvy investment insights that caught my attention—it was the reflective oneness of a community bidding adieu to a beloved vice chairman and embracing a new epoch.

#

The Architect’s Legacy

Warren Buffett reverently dubs Munger as ‘the architect’ of modern Berkshire Hathaway, a name representing formidable business excellence. Indeed, from a humble New England textile mill to a conglomerate colossus, Berkshire’s evolution is no less than a corporate fairytale—albeit one rooted in shrewd decisions and unorthodox strategies.

In the past, these meetings were marathons of financial banter, and Munger’s absence was palpably felt. Yet, as Buffett and his vice chairs, Greg Abel and Ajit Jain, responded to the barrage of questions, one could sense Charlie’s spirit in every pause, every chuckle, and every punchy retort that has shaped Berkshire’s unique corporate culture.

#

Buffett’s Buffet of Insights: From Apple’s Portfolio Dance to International Tastes

Buffett’s quips on Berkshire’s equity dance with Apple Inc. (AAPL), his contentment over a burgeoning, $200 billion-strong treasury holding, and the conglomerate’s coy relationship with international investments were nothing short of enlightening.

But it’s his adamant preference for U.S. investment soil that stands out—almost as if he’s waving the stars and stripes through his portfolio choices. Buffett’s musings on the future ring with a candid recognition of time’s relentless march. At 93, his reflections underscore the importance of adaptive leadership—most notably, in his acknowledgment of the vast potential, both benign and ominous, of artificial intelligence (AI).

#

Words of Wisdom: From Auto Insurance Realpolitik to Florida’s Market Melodrama

The dialogue ventured into the auto insurance arena, where Buffett reminded us that collecting premiums isn’t all rainbows—risk awaits. Ajit Jain chimed in, coloring the canvas with the trials of Florida’s tumultuous insurance market. Amid skyrocketing auto insurance rates and the quirks of Florida’s market dynamics, Jain’s hope for a ‘fairly buoyant’ future highlights the ebb and flow of risk and reward—an enduring theme in Berkshire’s investment philosophy.

#

AI Anxieties & Inspirations: A Cautionary Tale from the Oracle Himself

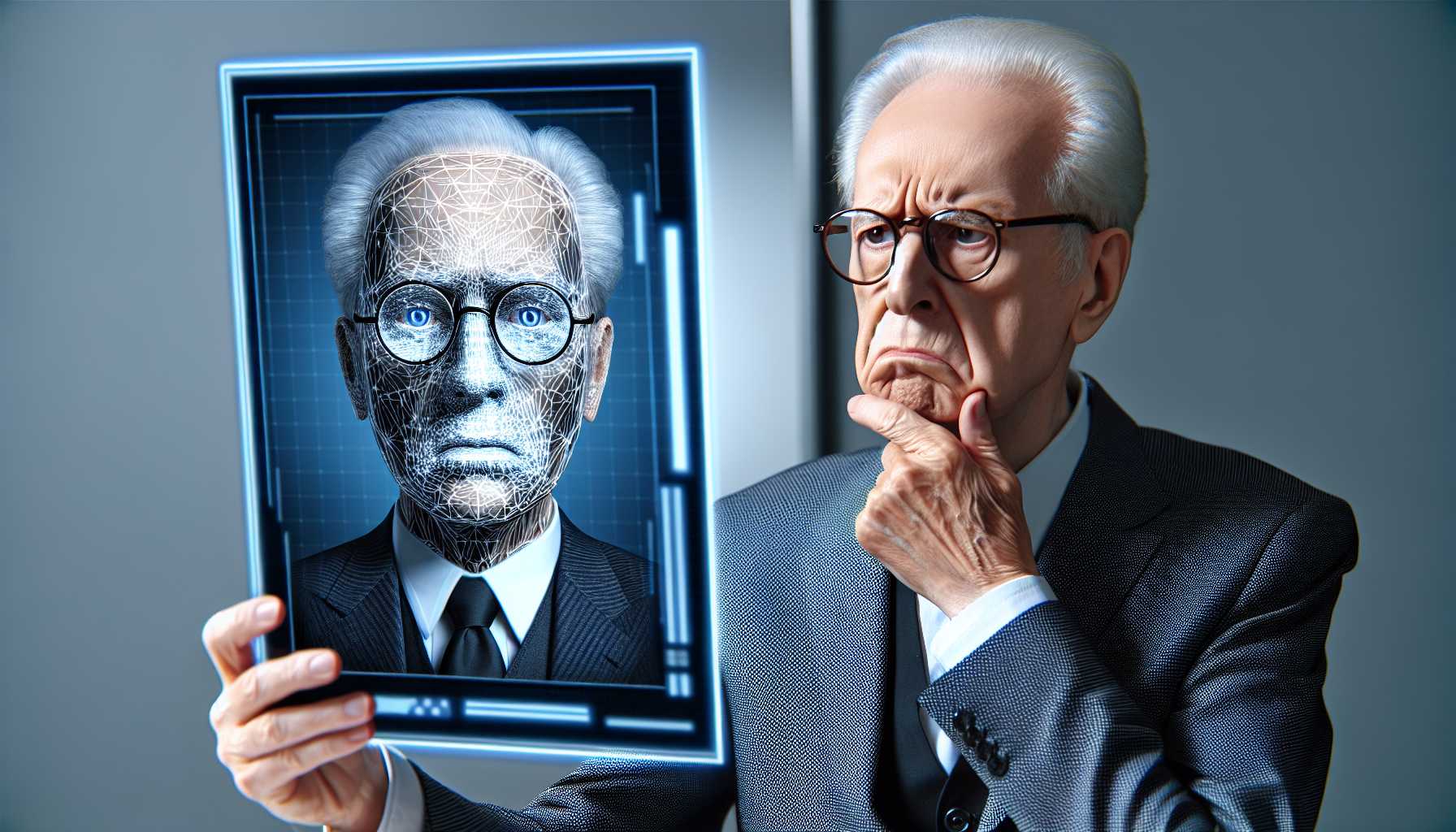

Buffett’s cautious stance on AI, as it teeters on the edge of remarkable promise and perilous pitfalls, resonates with the tech community. His near-Orwellian encounter with an AI mimicry of himself underscores the burgeoning responsibility resting on the shoulders of tech developers and policy-makers alike.

#

The Munger Effect: BYD and Costco Investments

Buffett’s admiration for Munger’s investment acumen shines through in his continued faith in BYD, a Chinese electric vehicle manufacturer, and Costco, a retail giant. These investments, handpicked by Munger, stand as testaments to his visionary approach and unwavering belief in long-term value.

#

A New Chapter Unfolds

The 2023 Berkshire Hathaway annual meeting marked a bittersweet transition. While the absence of Charlie Munger was deeply felt, the spirit of his wisdom and the legacy he built will undoubtedly continue to guide Berkshire Hathaway’s journey into the future. As the curtain closed on this year’s gathering, one couldn’t help but feel a sense of anticipation for the new chapter that lies ahead.