The Tech Stock Market: Navigating the Bumpy Ride of AI, Utilities, and Analyst Opinions

The tech industry is a whirlwind of innovation, with artificial intelligence (AI) at the forefront. But even the most groundbreaking advancements can hit snags. Let’s explore the current tech stock market landscape, separating the gold from the fool’s gold amidst industry shake-ups.

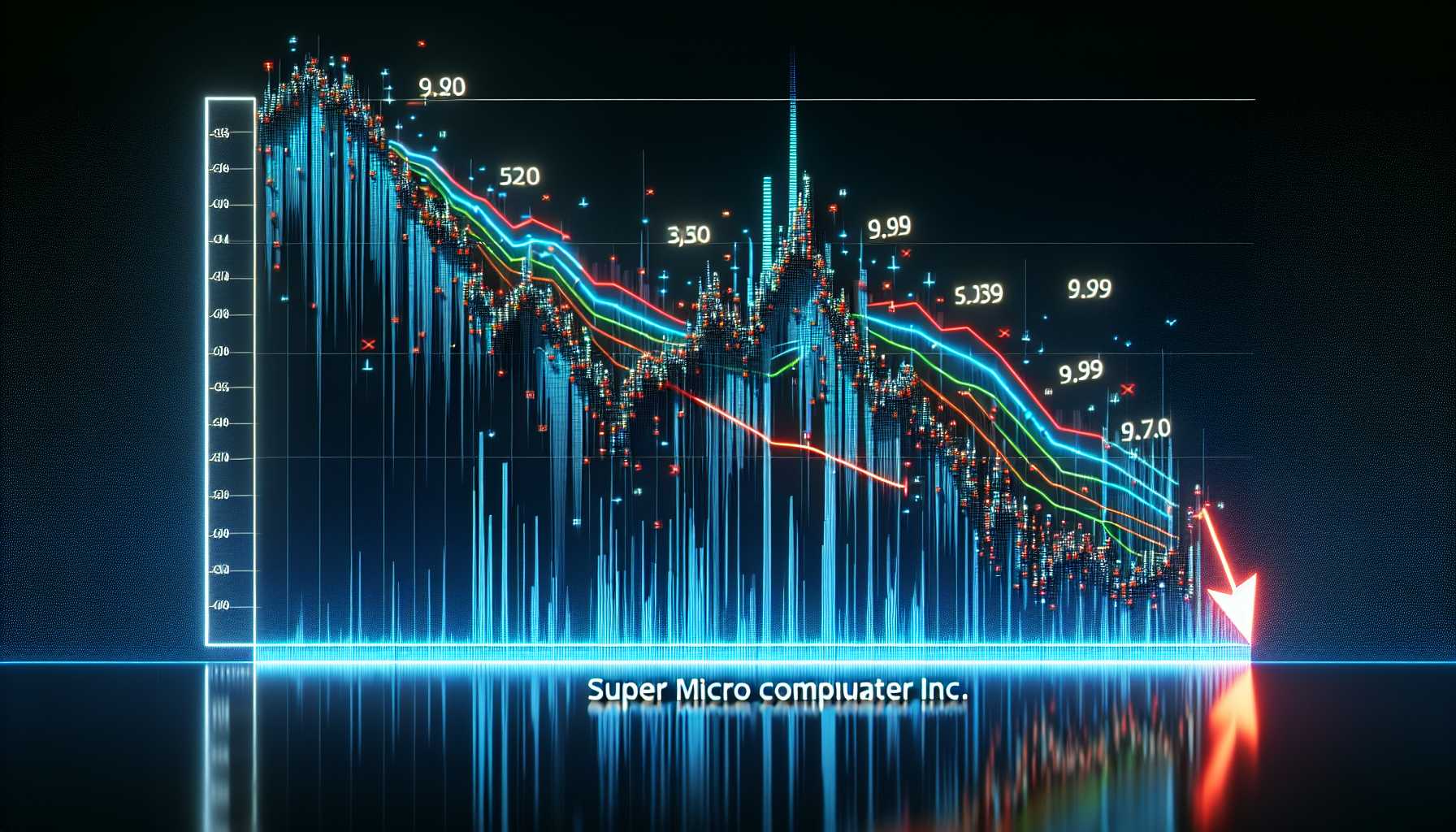

The AI Tumble: A Reality Check for Super Micro

Super Micro Computer Inc.’s stock took a nosedive, dragging down the tech sector’s AI enthusiasm. The Nasdaq 100 Index saw its fourth consecutive week in the red. This serves as a reminder that even the most promising AI stocks can experience setbacks. Investor optimism can be fickle, and when expectations aren’t met, the market reacts swiftly.

Utilities Emerge as Safe Havens

While AI stocks were on a roller coaster, utility stocks like NextEra Energy and York Water surged ahead. These companies offer stability and steady returns, a welcome contrast to the volatility of the tech sector. NextEra’s focus on renewable energy and York Water’s uninterrupted dividend since 1816 make them attractive long-term investments.

Analyst Opinions: A Double-Edged Sword

Analysts’ opinions can significantly impact stock prices. Super Micro Computer’s hold rating from Wells Fargo led to investor jitters and a stock price drop. Similarly, Tesla and Palantir face potential downsides according to some analysts. These warnings highlight the importance of considering both the potential and the risks associated with even the most promising tech companies.

ETFs: Stability in Market Turbulence

Exchange-traded funds (ETFs) offer stability during market volatility. The Vanguard S&P 500 ETF and the Vanguard Total Stock Market ETF provide diversified exposure to the tech sector without the risk of individual stock fluctuations. These ETFs are ideal for investors seeking long-term growth with lower volatility.

Meta’s Quest for Affordable VR

Meta’s price reduction on its Quest 2 VR headset aims to increase accessibility and drive mass adoption. This move positions the Quest 2 as an attractive entry point into the world of VR, while the more powerful Quest 3 represents Meta’s future vision for the technology.

Conclusion: A Multi-Faceted Landscape

The tech stock market is a complex and dynamic landscape. While AI holds immense potential, it’s not immune to market forces. Utilities offer stability, while analyst opinions can influence investor sentiment. ETFs provide diversification, and Meta’s VR strategy focuses on affordability. As the tech industry continues to evolve, investors must navigate this multifaceted landscape with a keen eye and a diversified portfolio.

Stay tuned for our next techno-trek, where we’ll delve deeper into the ever-changing world of tech and its impact on our lives.