The AI Revolution: Investment Opportunities in the Age of Intelligence

The tech world is buzzing with the latest advancements in artificial intelligence (AI), particularly the groundbreaking work being done by Nvidia. As one of the primary players in the AI ecosystem, Nvidia continues to push the envelope, not only with its state-of-the-art GPUs but also by setting industry trends like stock splits. Let’s dive deeply into the latest news, implications, and investment opportunities in this fascinating arena.

Nvidia’s Massive Stock Split: What Investors Need to Know

Nvidia’s 10-for-1 Stock Split: A Closer Look

Nvidia (NASDAQ: NVDA), the juggernaut of the semiconductor and AI industry, recently announced a 10-for-1 stock split, an enthusiastic gesture to make its shares more accessible to a broader range of investors. Come June 7, 2024, investors will receive nine additional shares for each share they hold as of June 6. This move marks Nvidia’s second split in less than three years.

For the uninitiated, a stock split increases the number of shares while reducing the price per share, without affecting the company’s market capitalization. Therefore, if an investor owns one share worth $1,000 before the split, they’ll hold ten shares worth $100 each post-split. The value remains unchanged, but the perception of affordability can attract retail investors, thereby potentially boosting trading activity and liquidity.

Interestingly, stock splits often follow significant price appreciation, and Nvidia’s stellar performance lately justifies this move. The company reported first-quarter revenue more than tripled, led by its high-demand H100, A100, and Blackwell GPUs, fueling the AI revolution. With Nvidia expected to dominate the AI landscape for the foreseeable future, this split could indeed galvanize further investor interest.

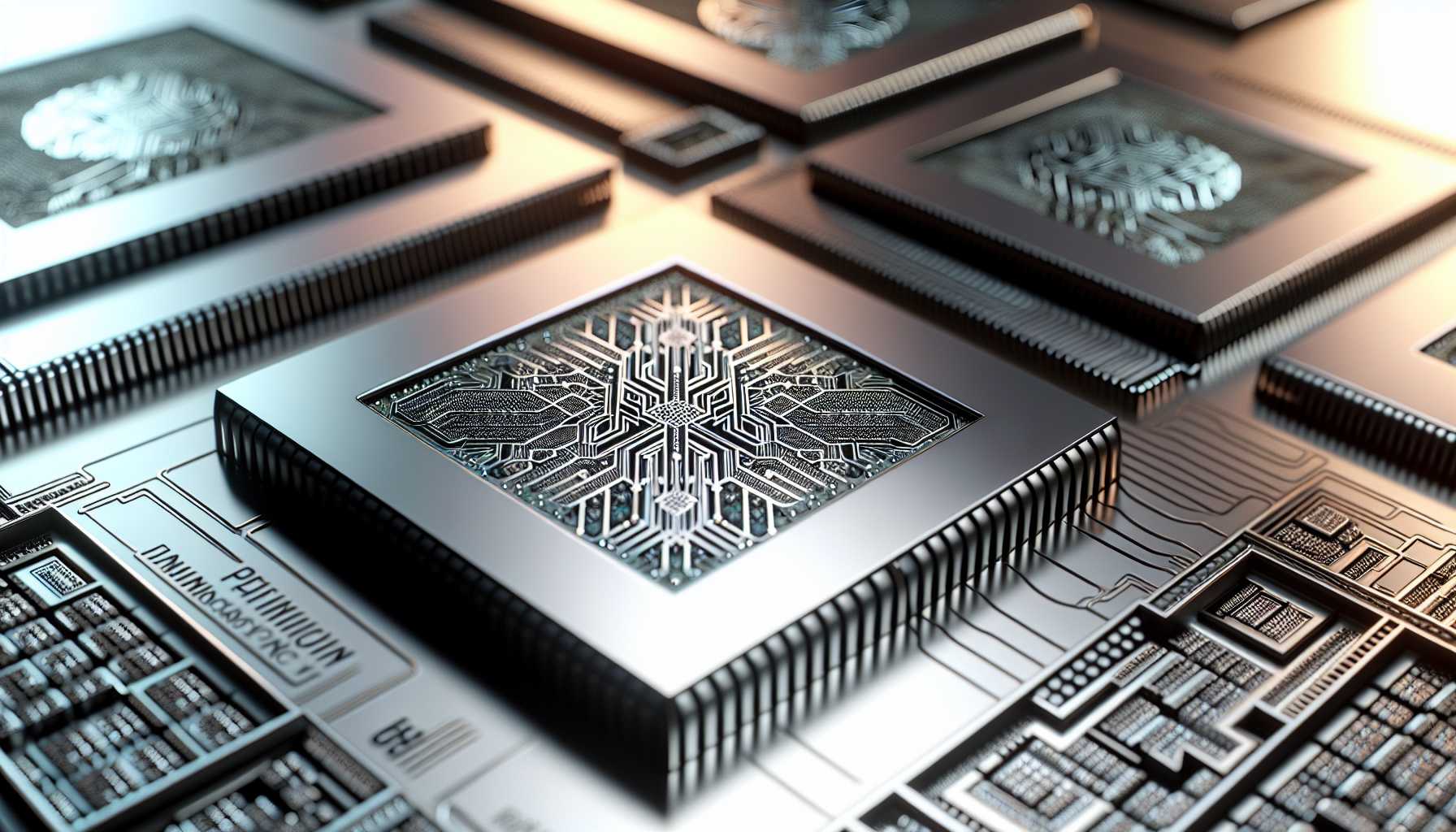

Nvidia’s Technological Edge

Nvidia holds a formidable position in AI and accelerated computing, commanding over 95% market share in workstation graphics processors and 90% in data center GPUs. This is further reinforced by an unmatched ecosystem, including software like CUDA for task acceleration and subscription-based cloud services.

The secret sauce lies in Nvidia’s comprehensive suite—hardware, software, and services—that makes it an invaluable player in AI applications across diverse sectors. By consistently delivering cutting-edge technology, Nvidia retains a competitive edge, catalyzing impressive financial results quarter after quarter.

ServiceNow: The Next Stock Split Candidate?

Is ServiceNow the Next Nvidia?

Another potential stock-split contender is ServiceNow (NYSE: NOW), an AI-centric software giant. ServiceNow’s platform helps businesses digitize and automate workflows, enhancing efficiency across departments. With an emphasis on AI, even incorporating generative AI capabilities into its products such as Now Assist, ServiceNow is aggressively positioning itself as a leader in enterprise automation.

ServiceNow’s recent financial performance echoes this optimism, with Q1 revenue fetching $2.6 billion, a 24% increase year-over-year. Despite subdued guidance, the company reaffirms its robust growth projections, aiming for a 17% annual growth in addressable market to reach $275 billion by 2026.

Investment Potential

Wall Street projects a 30% compound annual growth rate (CAGR) in ServiceNow’s earnings per share over the next three to five years. With current valuation metrics more accessible than ever, ServiceNow presents a lucrative opportunity for long-term growth investors.

Broadcom: An Intriguing Semiconductor Play

Brad Gerstner’s Bet on Broadcom

Amid Nvidia’s meteoric rise, savvy investors like Brad Gerstner are diversifying their semiconductor portfolios. Gerstner’s Altimeter Capital recently trimmed its Nvidia holdings and initiated a position in Broadcom (NASDAQ: AVGO), signaling the potential of the latter in the AI landscape.

Broadcom specializes in network infrastructure, crucial for large language model (LLM) performance. With the global market for network AI solutions expected to grow at a 38% CAGR, Broadcom’s strategic positioning makes it a compelling long-term play.

Diversified Exposure to AI

By focusing on network infrastructure, Broadcom could benefit significantly from the ongoing AI revolution. As generative AI models like ChatGPT and Gemini become ubiquitous, the demand for advanced network solutions will spike, reinforcing Broadcom’s market position.

Intel’s Turning Point: A New Horizon

Intel’s Transition to AI and Foundry Business

Intel (NASDAQ: INTC), a traditional semiconductor powerhouse, is pivoting towards AI with promising initiatives. Intel is rolling out the Intel Core Ultra mobile processors, making significant strides into the AI PC market. Moreover, it recently launched the Gaudi 3 AI accelerator, claiming performance superior to Nvidia’s H100 chip.

Intel is also opening its US-based foundry services to other companies, a strategic move aimed at capturing a substantial slice of the ever-growing semiconductor market. The foundry initiative looks promising, supported by substantial investments designed to scale operations and capture market share from global giants like Taiwan Semiconductor.

Investment Outlook for Intel

Currently trading at a relatively modest 27 times forward earnings, Intel appears to offer significant upside potential. With ambitious plans for its foundry business and renewed focus on AI, Intel might just be at the cusp of a transformative growth era.

Keep an Eye on Software and Cloud Giants

Amazon: A Software and Cloud Behemoth

No discussion of the tech and AI world is complete without Amazon (NASDAQ: AMZN). The e-commerce and cloud giant is harnessing AI across various domains, from logistics and inventory management to customer recommendations and AWS enhancements. Amazon’s deep investments in AI tools like Amazon Bedrock, Q, and Sagemaker illustrate its commitment to maintaining technological edge and market leadership.

With Amazon’s continuing growth in e-commerce and cloud services, coupled with its aggressive foray into AI, the company presents an exciting investment proposition for those looking for diversified tech exposure.

Toast: Emerging SaaS Player

Toast (NYSE: TOST), although not as widely known as Amazon, has been an interesting player in the software-as-a-service (SaaS) market for restaurants. By offering financial technology solutions and embracing AI, Toast is carving out a substantial market share in the restaurant software industry.

Despite being relatively new, it has shown impressive growth metrics and holds promising potential for future scalability.

The AI Hardware Conundrum: Beyond Nvidia

Nvidia’s Impact on Other Semiconductor Stocks

Nvidia’s rise has lifted other semiconductor stocks like AMD (NASDAQ: AMD) and TSMC (NYSE: TSM). AMD, while playing second fiddle to Nvidia, is leveraging the AI boom to expand its reach. CEO Lisa Su has emphasized strong demand for AI GPUs, potentially pushing AMD closer to a significant market share.

Meanwhile, TSMC’s central role in manufacturing Nvidia’s cutting-edge chips—with plans for massive capacity expansion—positions it favorably to capitalize on accelerating AI chip demand. Both AMD and TSMC stand as beneficiaries of the ongoing AI hardware expansion.

Super Micro Computer: An Under-the-Radar AI Beneficiary

Super Micro Computer’s Stellar Performance

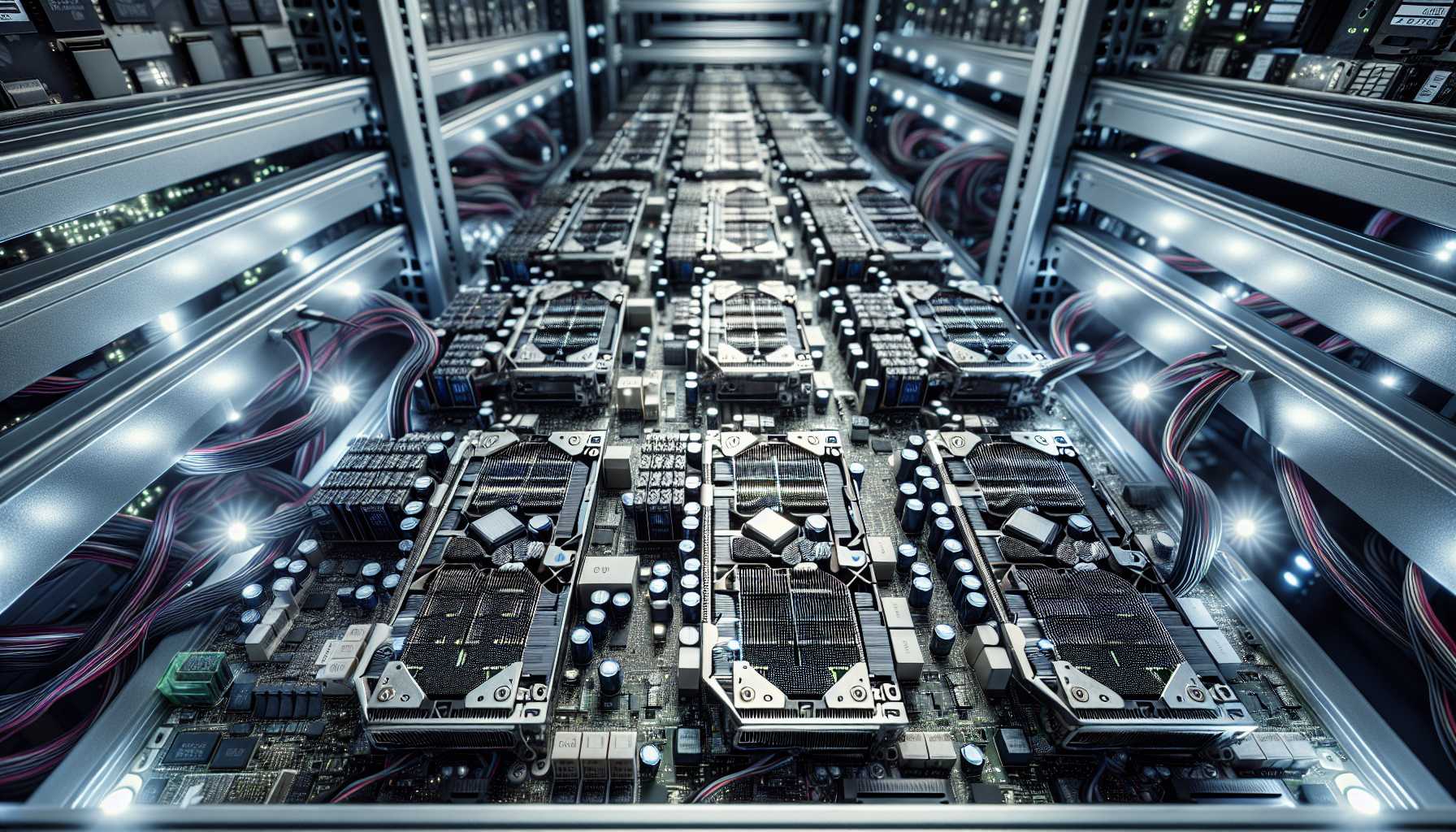

Another interesting player is Super Micro Computer (NASDAQ: SMCI). Similar to Nvidia, Supermicro has seen its stock soar owing to its high-density server solutions tailored for AI applications. With deep-rooted relationships in the industry and rapid product innovation, Supermicro delivers compelling solutions faster than its peers.

Despite recent market turbulence, Supermicro remains a robust AI infrastructure player. Its competitive advantages—strong alignment with Nvidia, swift market entries, and efficient liquid-cooling solutions—help it cater to burgeoning AI demand effectively.

Conclusion: Let’s Talk Investment Strategy

Strategic Investment in AI and Semiconductor Stocks

Navigating the AI and semiconductor landscape can be overwhelming, but strategic investments in industry leaders like Nvidia, tech giants like Amazon, innovative companies like Toast, and crucial infrastructure providers like TSMC or Supermicro could offer substantial returns.

While Nvidia’s stock split generates excitement, understanding the underlying technological advancements and market dynamics provides a more compelling reason to invest. Keep an eye on potential disruptors like ServiceNow or resilient players like Intel, as these companies are positioning themselves for long-term gains in the AI era.

As always, a diversified portfolio and long-term perspective remain key. Happy investing!