Welcome to the modern-day gold rush, where the nuggets have been replaced with silicon chips, and instead of panning streams, we’re streaming data. Yes, the tech terrain has taken us on a wild ride, and there’s no better example than the behemoth Nvidia joining the $2 trillion club. But wait, there’s more than just the glitz of market capitalization gliding us through the digital landscape. We’ll explore a European venture capital exodus, Amazon and Supermicro’s strategic moves, and the ever-intensifying AI arms race. Buckle up, tech enthusiasts; it’s an entertaining expedition through bytes and billions.

Nvidia’s Market Cap Magic: A Silicon Valley Sequel

If you haven’t heard the name Nvidia whispered on the wind of every tech town from San Francisco to Seoul, it’s time to tune in. The first chipmaker to swagger into the swanky $2 trillion market cap soiree has just set a whole new standard in the silicon soiree. It’s like watching a silicon-based Cinderella story, where, instead of a glass slipper, we have a high-performance GPU fitting perfectly into the market’s expectations. In its latest catwalk down the fiscal runway, Nvidia flaunted a whopping $60.9 billion in 2023 revenue, flexing a 126% bicep bulge from the previous year. All eyes are on the company’s foray into the AI chip market, which is a lot like the Marvel Cinematic Universe – dazzling, dominant, and disruptive. This kind of growth trajectory is akin to a tech aficionado’s wildest overclocked dreams, complete with RGB lighting.

Europe’s Venture Capital Voyage: Navigating Choppy Waters

Crossing the pond, we encounter a tale of ambition, realization, and retreat as North American VCs packed up their dreams like overoptimistic tourists after a European sojourn. They came for the ‘next big Spotify’ but found themselves grappling with a multitude of tongues and regulatory tunes more complex than a fugue by Bach. Rumblings reveal that big VC names have quietly tiptoed out, and those that remain are wading through deals as if stepping on pebbles in murky waters. It’s an entrepreneurial ecosystem rife with potential but peppered with pitfalls that would test the mettle of the most adventuresome investors.

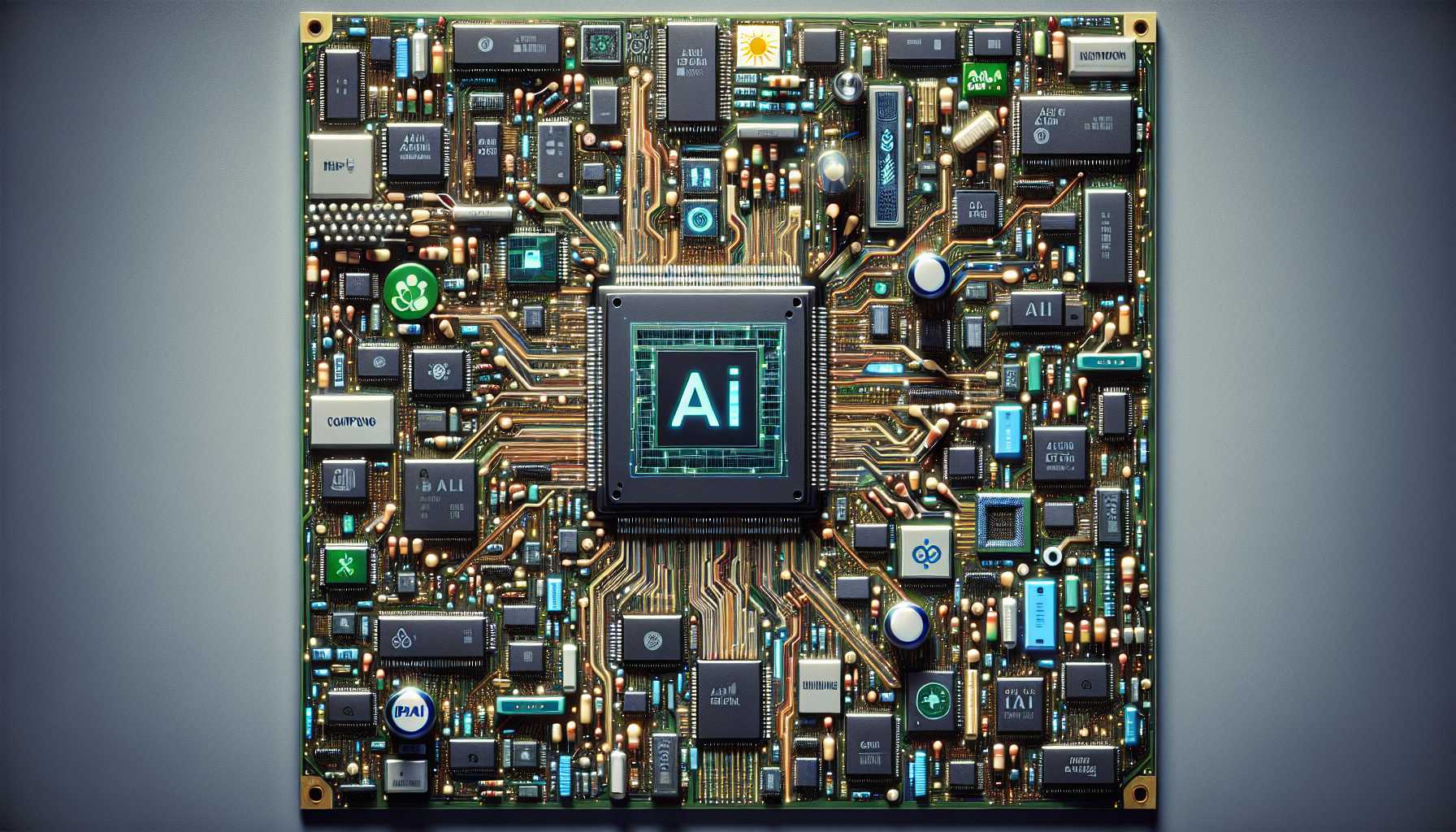

The AI Chip Chessboard: A Strategy Beyond Nvidia

In the electrifying world of AI chips, playing second fiddle to Nvidia is akin to trying to catch a greased eel. Amidst this high-stakes game, Amazon’s AWS has emerged as a silent partner, dancing in step with Nvidia to create AI supercomputers. Likewise, Super Micro Computer, or Supermicro, rides high on the silicon wave by employing a bespoke blend of the latest chips for its servers. However, the plot thickens as AMD steps onto the scene with its Instinct GPUs and gleaming armor, poised to challenge Nvidia’s stronghold. The competition is not just heating up; it’s on the verge of combustion. Will Supermicro pivot to the siren call of AMD, balancing its portfolio and potentially reshaping the market? Only time will tell in this electric dance of dominance and dexterity.

The Billionaire’s Blueprint: AI Stocks Painting a Prosperous Future

Amidst the boom of billionaires being minted, the quiet hum of AI stocks pulses with the promise of prosperity. Microsoft and Nvidia have become the master’s portraits in the gallery of wealth creation, their frames polished by the brilliance of AI innovation. Microsoft, the sage of the software sector, has cast its gaze toward blossoming its search and news advertising into a force that could rival the Googles and Facebooks of the world. And Nvidia, ever the sovereign of silicon, lays down the law in AI acceleration with CUDA, its secret sauce. Whether you’re a day-one investor or simply an intrigued onlooker, these two tech titans exemplify an industry where innovation propels not just algorithms, but affluence. They unfold a narrative where each product launch and partnership penned could be the prelude to a wealth of opportunities.

In conclusion, Nvidia, European venture capital ventures, along with Amazon and Supermicro’s strategic gambits, paint a spellbinding portrait of an industry in flux. Unfolding AI advancements evoke a future as rich in potential as it is brimming with risk. After all, in the world of tech, where there is disruption, there lies opportunity – for the agile, the insightful, and the bold.