The Tech World: Unpacking Trends and Tidbits

The technology industry is a whirlwind of constant developments. Let’s delve into some of the latest trends and intriguing insights, providing context and color to help you make sense of the digital landscape.

Stripe’s Financial Automation Revolution

Stripe, the digital payments giant, is expanding its services into financial automation. Its Revenue and Finance Automation (RFA) unit is projected to reach a $500 million annual run rate, highlighting the sector’s growth.

Stripe’s acquisition of Supaglue, a platform for user-facing integration tools, is particularly noteworthy. Supaglue addresses the common problem of fragmented data in the tech ecosystem, which can lead to poor decision-making. This acquisition could enhance Stripe’s real-time analytics and reporting capabilities.

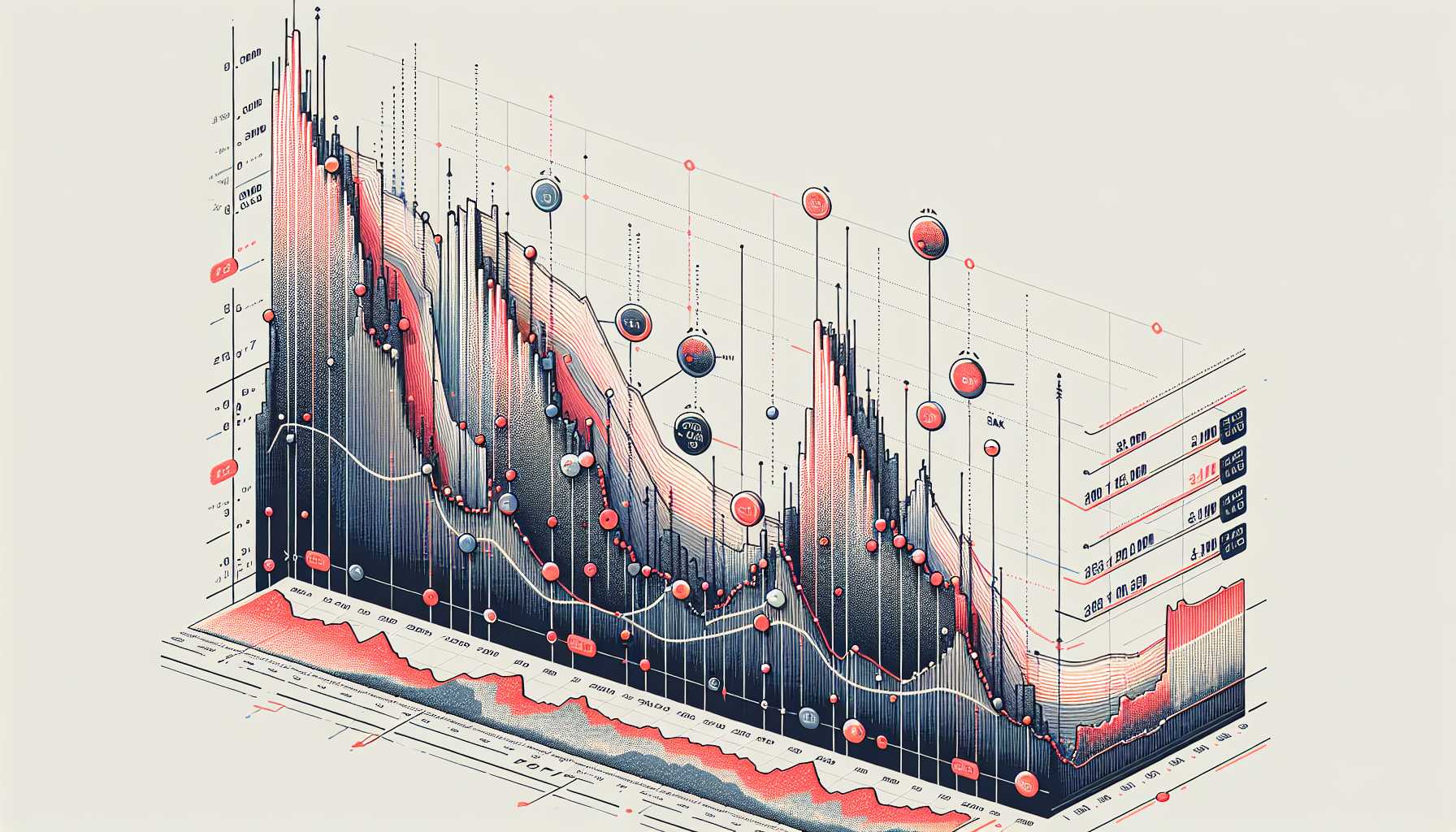

Buffett’s Thermometer: Stock Market Fever

The Buffett Indicator, named after Warren Buffett, measures the stock market’s temperature by comparing market capitalization to GDP. When this indicator exceeds 190%, as it has recently, it suggests an overheated market.

Investors are closely monitoring this indicator, balancing caution with the allure of AI stocks. Some experts, like JPMorgan CEO Jamie Dimon, view the AI excitement as a sign of substantial growth potential.

The AI Gold Rush: Nvidia’s Dominance and Beyond

AI has taken center stage, with Nvidia leading the charge in data center growth. However, the industry is also buzzing about the energy needs of AI, which could create new opportunities.

While Nvidia’s growth is impressive, investors are also considering undervalued players who could benefit from the AI boom. Billionaire David Tepper has invested in AI stocks like Oracle and Amazon.

Berkshire Hathaway’s Dividend Delights

Warren Buffett’s Berkshire Hathaway has a strong track record of dividend payments. Investments in companies like Bank of America, Occidental Petroleum, and Apple have generated a steady stream of income.

Buffett’s focus on dividends reflects his belief in companies that produce value over time. Reliable, brand-name businesses often lead to consistent returns.

Super Micro’s Slip-Up: A Tech Investor’s Dream?

Super Micro Computer’s recent stock dip has caught the attention of tech investors. Some see it as an opportunity to invest in a strong AI server player at a discounted price.

While some investors may be hesitant, others recognize Super Micro’s strategy to expand its production capacities, which aligns with the growing demand for AI servers.

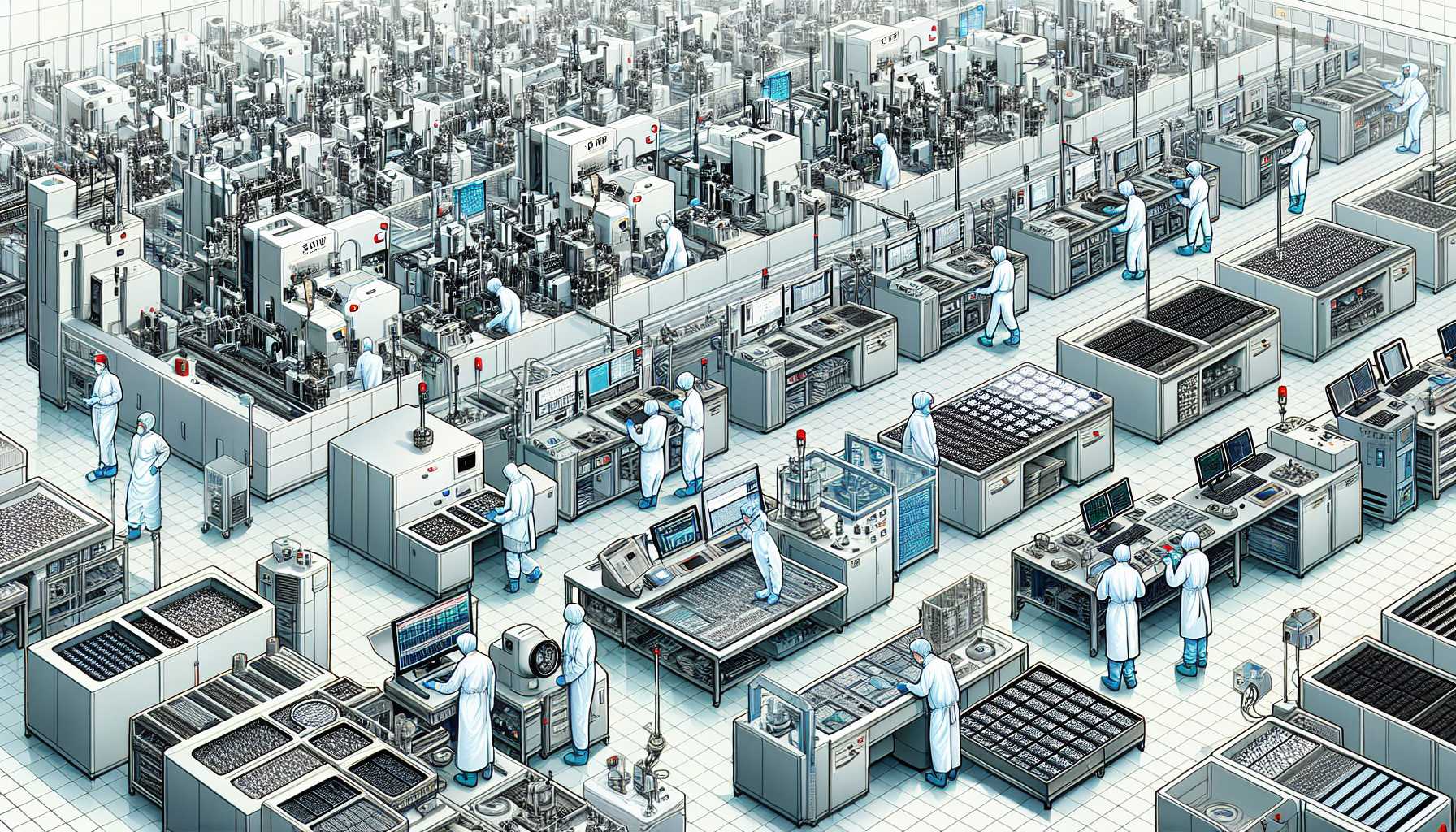

To Buy or Not to Buy: Micron Technology After Earnings Surge

Micron Technology’s earnings surge has impressed investors. The chipmaker’s profit leap, driven by demand for AI servers, raises the question of whether investing in Micron is a smart move.

Investors must carefully consider the risks and potential rewards before making a decision.

Spicy Investments: McCormick & Company’s Dividend Flavor

Beyond tech, McCormick & Company’s dividend history and high yield are attractive to investors. This spice giant’s resilience and consistent dividend payments demonstrate that traditional companies can also offer solid returns.

It’s a reminder that tech isn’t the only sector worth considering.

Chasing AI’s Horizon: Nvidia’s Competition and ETF Opportunities

While Nvidia dominates the AI landscape, competition is growing. Investors are exploring ways to diversify their AI investments.

ETFs like Roundhill Generative AI and Technology ETF offer exposure to a range of tech companies, including Microsoft, Alphabet, and Nvidia. As AI applications continue to evolve, these ETFs provide a way to participate in the growth potential.

The tech world is a dynamic and ever-changing landscape. By staying informed about the latest trends and insights, you can make informed decisions and navigate the digital landscape with confidence.